Question: Exercise 12-16 (Algorithmic) (LO. 7) Holbrook, a calendar year S corporation, distributes $106,300 cash to its only shareholder, Cody, on December 31. Cody's basis in

Exercise 12-16 (Algorithmic) (LO. 7)

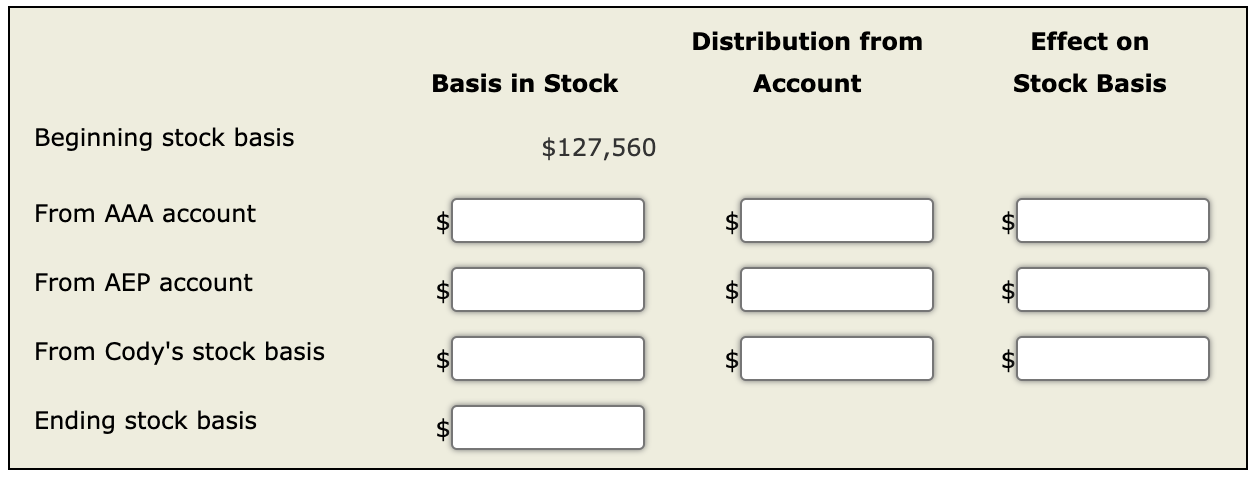

Holbrook, a calendar year S corporation, distributes $106,300 cash to its only shareholder, Cody, on December 31. Cody's basis in his stock is $127,560, Holbrook's AAA balance is $47,835, and Holbrook has $15,945 AEP before the distribution. According to the distribution ordering rules, complete the chart below to indicate how much of the $106,300 is from AAA and AEP as well as how Cody's stock basis is affected.

If an amount is zero, enter "0".

BasisinStockDistributionfromAccountEffectonStockBasis Beginning stock basis $127,560 From AAA account From AEP account From Cody's stock basis Ending stock basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts