Question: Exercise 12-16 (Algorithmic) (LO. 7) Holbrook, a calendar year S corporation, distributes $30,700 cash to its only shareholder, Cody, on December 31 . Cody's basis

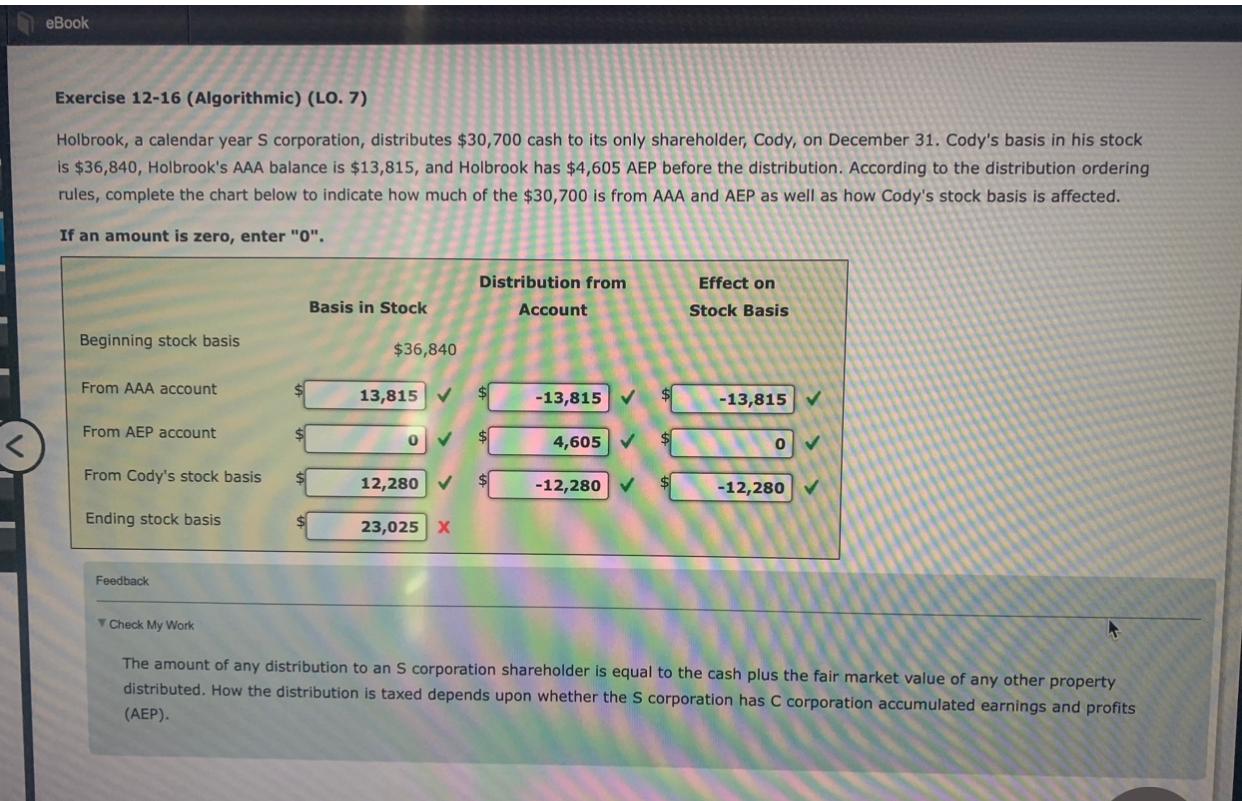

Exercise 12-16 (Algorithmic) (LO. 7) Holbrook, a calendar year S corporation, distributes $30,700 cash to its only shareholder, Cody, on December 31 . Cody's basis in his stock is $36,840, Holbrook's AAA balance is $13,815, and Holbrook has $4,605 AEP before the distribution. According to the distribution ordering rules, complete the chart below to indicate how much of the $30,700 is from AAA and AEP as well as how Cody's stock basis is affected. If an amount is zero, enter " 0 ". Feedback T Check My Work The amount of any distribution to an S corporation shareholder is equal to the cash plus the fair market value of any other property distributed. How the distribution is taxed depends upon whether the S corporation has C corporation accumulated earnings and profits (AEP)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts