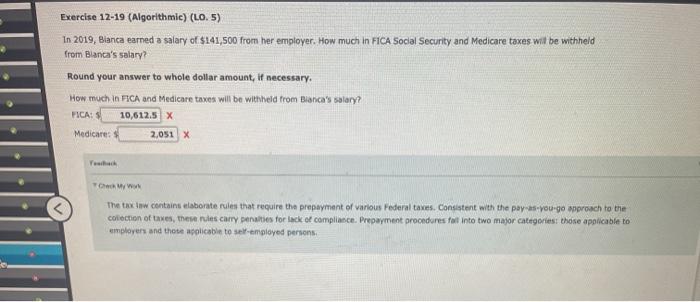

Question: Exercise 12-19 (Algorithmic) (LO. 5) In 2019, Bianca earned a salary of $141,500 from her employer. How much in FICA Social Security and Medicare taxes

Exercise 12-19 (Algorithmic) (LO. 5) In 2019, Bianca earned a salary of $141,500 from her employer. How much in FICA Social Security and Medicare taxes will be withheld from Blanca's salary? Round your answer to whole dollar amount, if necessary. How much in FICA and Medicare taxes will be with held from Bianca's salary? PICA: 10,612,5 x Medicare: $ 2,051 x The tax law contains elaborate rules that require the prepayment of various Federal taxes. Consistent with the pay-as-you-go approach to the collection of taxes, there is carry penalties for lack of compliance. Prepayment procedures fall into two major categories those applicable to employers and those colicable to self-employed persons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts