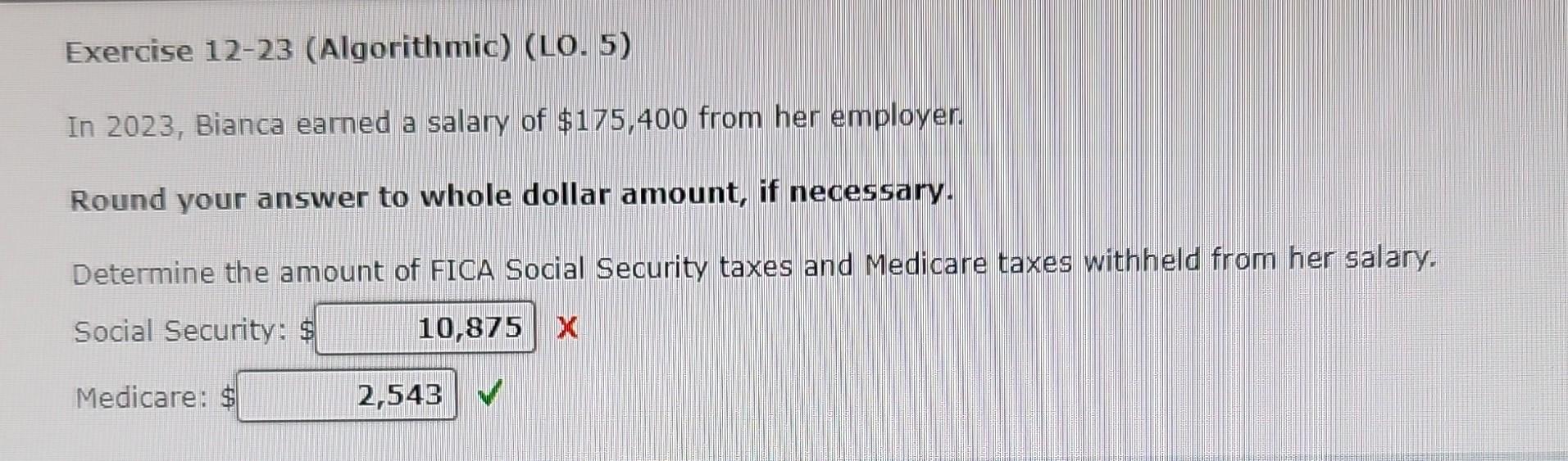

Question: Exercise 12-23 (Algorithmic) (LO. 5) In 2023, Bianca earned a salary of $175,400 from her employer. Round your answer to whole dollar amount, if necessary.

Exercise 12-23 (Algorithmic) (LO. 5) In 2023, Bianca earned a salary of $175,400 from her employer. Round your answer to whole dollar amount, if necessary. Determine the amount of FICA Social Security taxes and Medicare taxes withheld from her salary. Social Security: X Medicare: $ Jason, a single parent, lives in an apartment with his three minor children, whom he supports. Jason earned $28,400 during 2023 and uses the standard deduction. Click here to access Earned Income Credit and Phaseout Percentages Table. Round all computations to the nearest dollar. Calculate the amount, if any, of Jason's earned income credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts