Question: Exercise 12-20 (Algorithmic) (LO. 6) Holbrook, a calendar year S corporation, distributes $58,000 cash to its only shareholder, Cody, on December 31. Cody's basis in

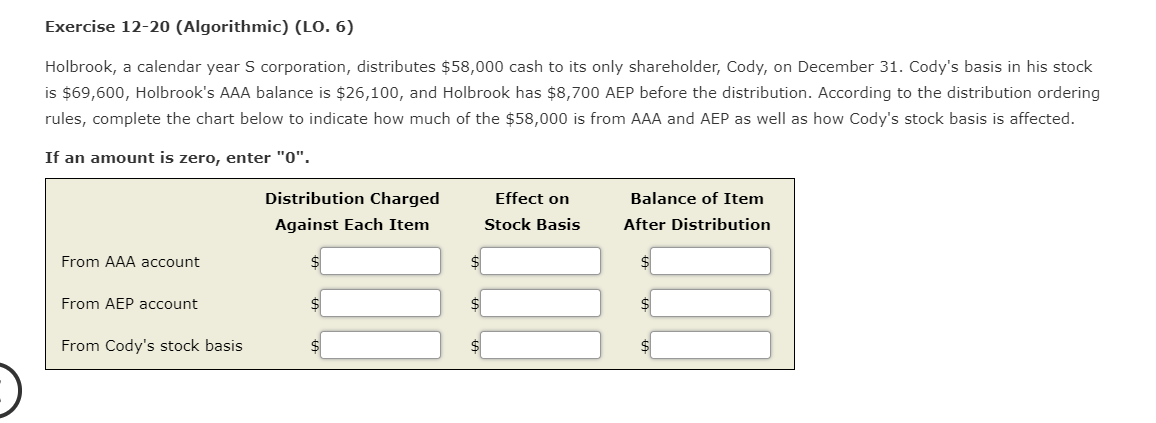

Exercise 12-20 (Algorithmic) (LO. 6) Holbrook, a calendar year S corporation, distributes $58,000 cash to its only shareholder, Cody, on December 31. Cody's basis in his stock is $69,600, Holbrook's AAA balance is $26,100, and Holbrook has $8,700 AEP before the distribution. According to the distribution ordering rules, complete the chart below to indicate how much of the $58,000 is from AAA and AEP as well as how Cody's stock basis is affected. If an amount is zero, enter "0". Distribution Charged Against Each Item Effect on Stock Basis Balance of Item After Distribution From AAA account From AEP account From Cody's stock basis 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts