Question: Exercise 13 A.2 (Algo) Net Cash Provided by Operating Activities [LO13-4] Wiley Company's tncome statement for Year 2 follows. The compony's celling and acrinistative expence

![Exercise 13 A.2 (Algo) Net Cash Provided by Operating Activities [LO13-4]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ebd0c15c6fa_43266ebd0c0e5507.jpg)

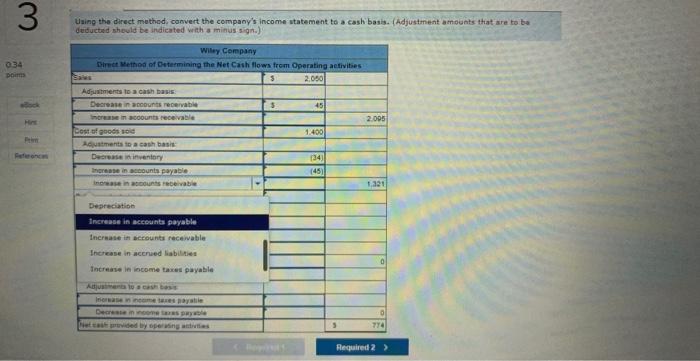

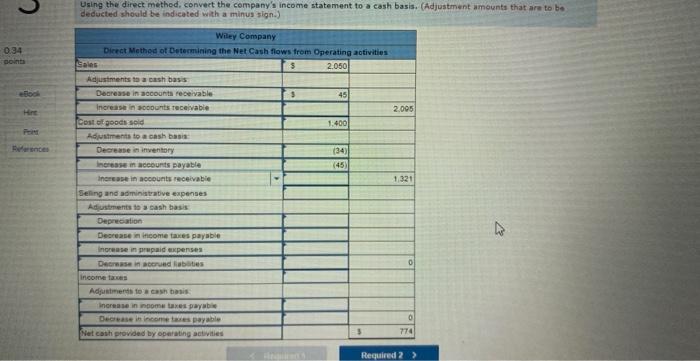

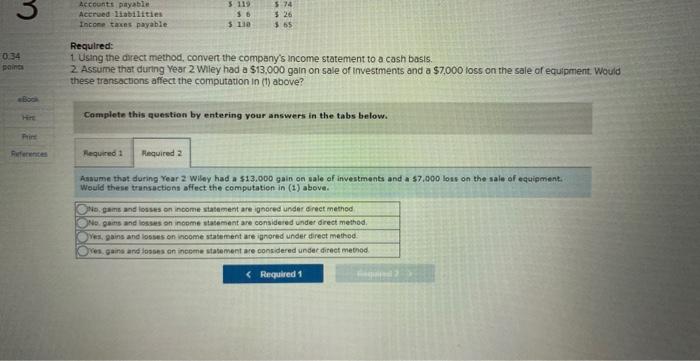

Exercise 13 A.2 (Algo) Net Cash Provided by Operating Activities [LO13-4] Wiley Company's tncome statement for Year 2 follows. The compony's celling and acrinistative expence for Year 2 includes 574 of depreciaton expense. Selected balance sheet accounts for Wiley at the end of years 1 and 2 are as follows: Recuired: 1. Using the direct methoc, compen the compary's income statement to o cash bacis 2. Aseume that during rear 2 Wiey had a $13,000 gain on sale of investments and a $7,000 loss on the sale of equipment. Would these transocters affect the computation in rV obove? Waing the direct methed, comvert the cormpany's income statement to a cash basis. (Adjustment ainounts that are to ba deducted should be indicated wiah a minus sign.) Using the direct methed, convert the company's income statement to a cash basis. (Andjustment amounts that are to be deducted should be indicated with a minus sign.) Required: 1. Using the direct method, convert the company's income statement to a cash basis. 2 Assume that during Year 2 Wiley had a $13,000 gain on sale of investments and a $7,000 loss on the sale of equipment. Would these transactions affect the computation in (1) above? Complete this avestion by entering your answers in the tabs below. Aasume that during Year 2 Wiley had a $13,000 gain on sale of investments and a $7,000 loss on the sale of equipment. Would these trunsactions affect the computatien in (1) above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts