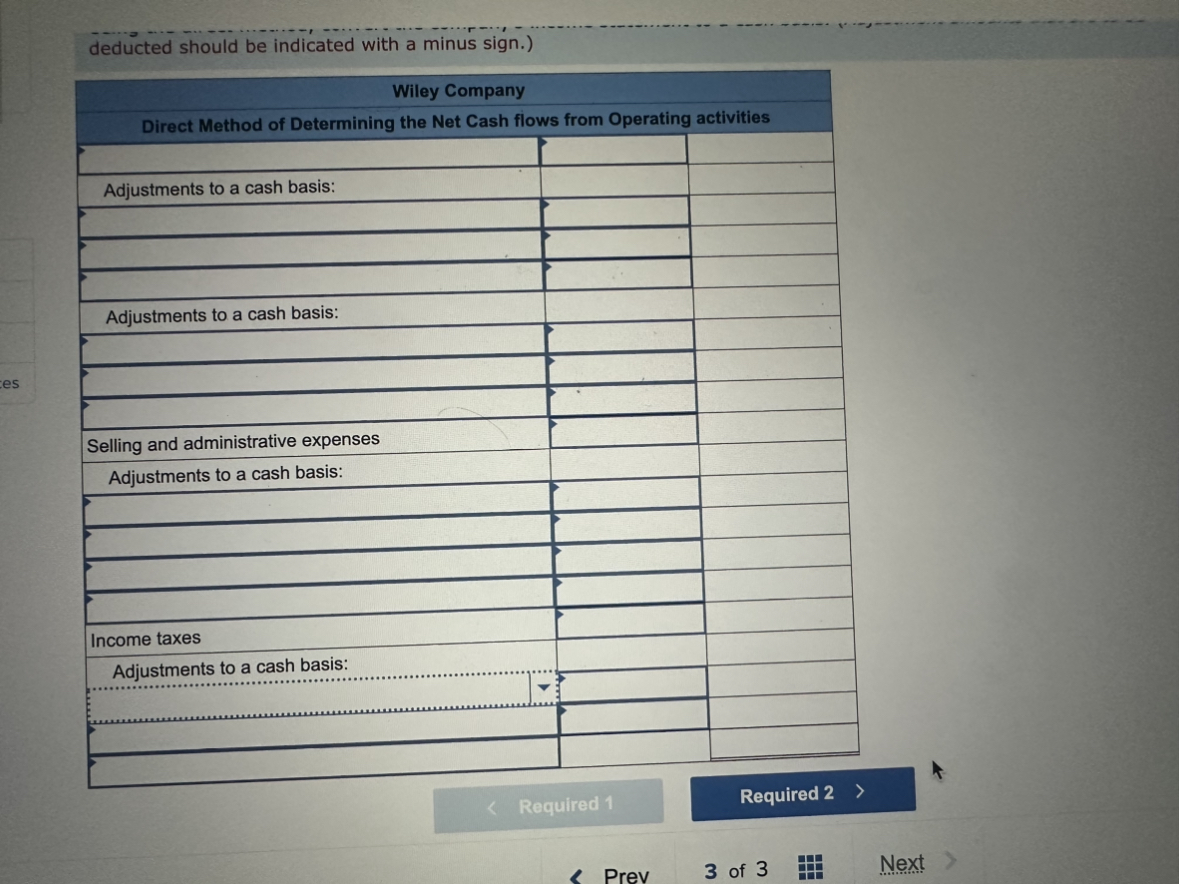

Question: Exercise 13A-2 (Algo) Net Cash Provided by Operating Activities [LO13-4] Wiley Company's income statement for Year 2 follows: The company's selling and administrative expense for

![Exercise 13A-2 (Algo) Net Cash Provided by Operating Activities [LO13-4] Wiley](https://s3.amazonaws.com/si.experts.images/answers/2024/08/66cd0cf21056a_22566cd0cf14109a.jpg)

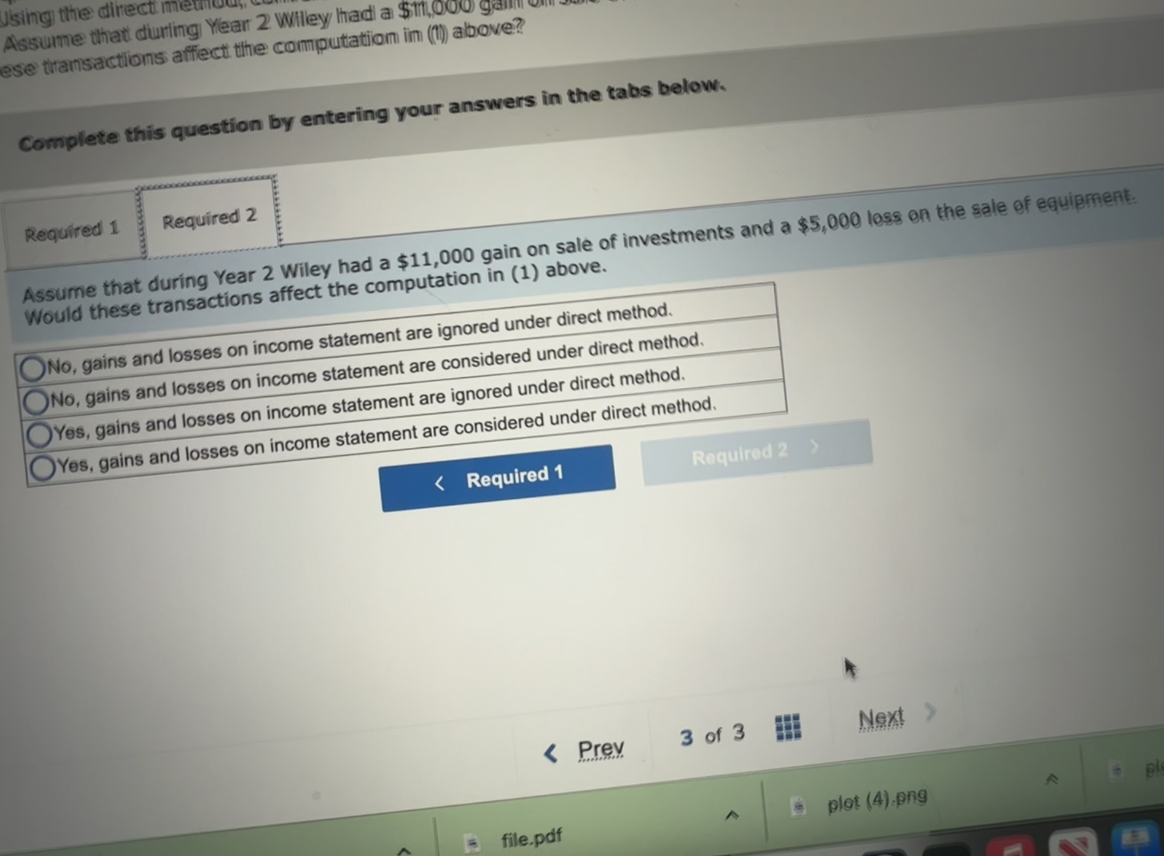

Exercise 13A-2 (Algo) Net Cash Provided by Operating Activities [LO13-4] Wiley Company's income statement for Year 2 follows: The company's selling and administrative expense for Year 2 includes $74 of depreciation expense. Selected balance sheet accounts for Wiley at the end of Years 1 and 2 are as follows: 1. Using the direct method, convert the company's income statement to a cash basis Required: 2. Assume that during Year 2 Wiley had a $11,000 gain on sale of investments and a $5,000 loss on the sale of equipment. Would these transactions affect the computation in (1) above? Complete this question by entering your answers in the tabs below. Andunted chnuld he indirated with a minus sian.) Complete this question by entering your answers in the tabs below. Assume that during Year 2 Wiley had a $11,000 gain on sale of investments and a $5,000 loss on the sale of equipraent: Would these transactions affect the computation in (1) above. No, gains and losses on income statement are ignored under direct method. No, gains and losses on income statement are considered under direct method. Yes, gains and losses on income statement are ignored under direct method. Yes, gains and losses on income statemant are considered under direct method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts