Question: Exercise 13-1, When completing the assignment, refer to Table 13-9 on page 263 and Equation 4-4 on page 70 Exercise 13-1: A representative of a

Exercise 13-1, When completing the assignment, refer to Table 13-9 on page 263 and Equation 4-4 on page 70

Exercise 13-1: A representative of a reputable financial services company has approached you as manager of a four-person group of anesthesiologists with an opportunity to purchase a 10-year annuity due for each member of the group. The annuity due would pay $40,000 each year beginning five years from now (i.e. at time = 5). What is the most you would be willing to pay now, per each physician, for this investment? Assume an appropriate discount rate of 7%.

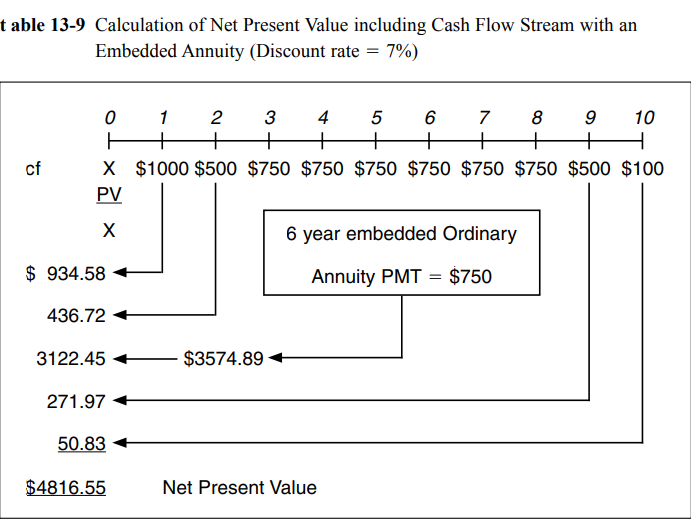

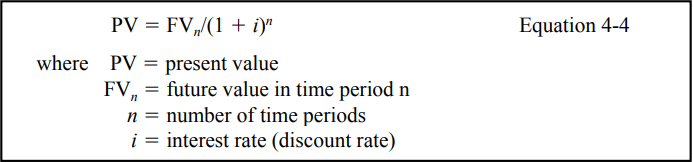

t able 13-9 Calculation of Net Present Value including Cash Flow Stream with an Embedded Annuity (Discount rate = 7%) 0 1 2 3 4 5 6 + + + + 7 8 9 10 + + + H + + cf X $1000 $500 $750 $750 $750 $750 $750 $750 $500 $100 PV X 6 year embedded Ordinary $ 934.58 Annuity PMT = $750 436.72 3122.45 271.97 50.83 $4816.55 $3574.89 Net Present Value PV = FV/(1 + i)" where PV = present value FV = future value in time period n n = number of time periods i = interest rate (discount rate) Equation 4-4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts