Question: When completing the assignment refer to Table 13-9, and Equation 4-4 A representative of a reputable financial services company has approached you as manager of

When completing the assignment refer to Table 13-9, and Equation 4-4

A representative of a reputable financial services company has approached you as manager of a four-person group of anesthesiologists with an opportunity to purchase a 10-year annuity due for each member of the group. The annuity due would pay $40,000 each year beginning five years from now (i.e. at time = 5). What is the most you would be willing to pay now, per each physician, for this investment? Assume an appropriate discount rate of 7%

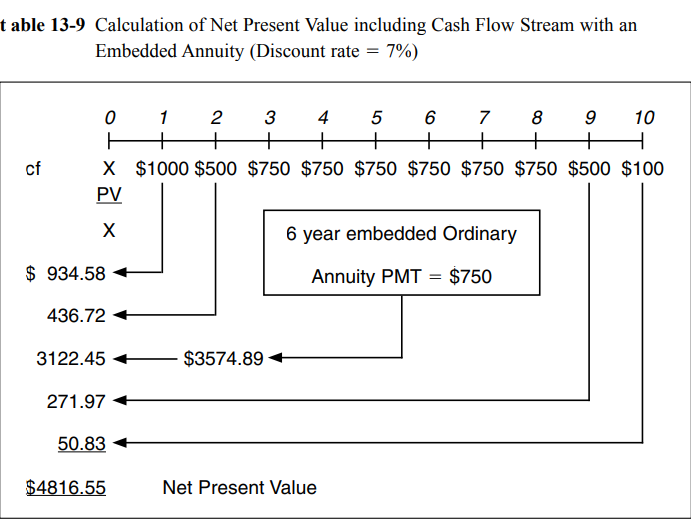

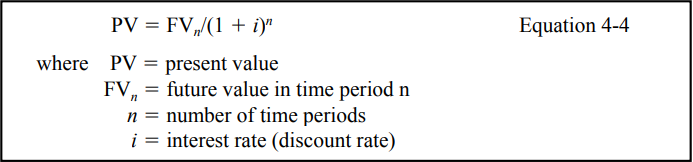

t able 13-9 Calculation of Net Present Value including Cash Flow Stream with an Embedded Annuity (Discount rate = 7%) 0 1 2 3 4 5 6 7 8 9 10 H + + + + + + + + + X $1000 $500 $750 $750 $750 $750 $750 $750 $500 $100 PV cf 6 year embedded Ordinary $ 934.58 Annuity PMT = $750 436.72 3122.45 $3574.89 271.97 50.83 $4816.55 Net Present Value Equation 4-4 PV = FV,/(1 + i)" where PV = present value = future value in time period n n = number of time periods i = interest rate (discount rate) FV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts