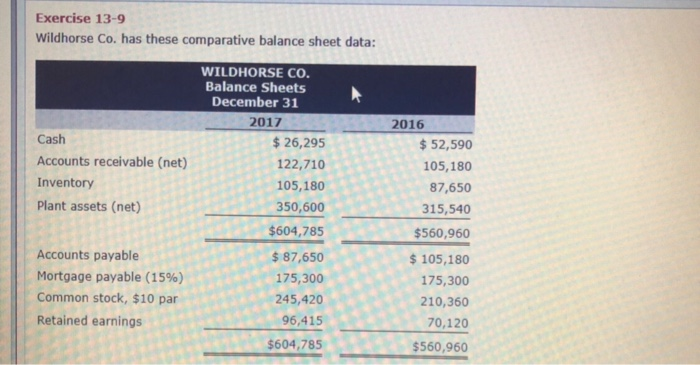

Question: Exercise 13-9 Wildhorse Co. has these comparative balance sheet data: Cash Accounts receivable (net) Inventory Plant assets (net) WILDHORSE CO. Balance Sheets December 31 2017

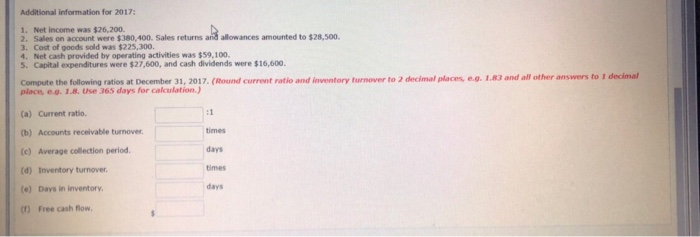

Exercise 13-9 Wildhorse Co. has these comparative balance sheet data: Cash Accounts receivable (net) Inventory Plant assets (net) WILDHORSE CO. Balance Sheets December 31 2017 $ 26,295 122,710 105,180 350,600 $604,785 $ 87,650 175,300 245,420 96,415 $604,785 2016 $ 52,590 105,180 87,650 315,540 $560,960 $ 105,180 175,300 210,360 70,120 $560,960 Accounts payable Mortgage payable (15%) Common stock, $10 par Retained earnings Additional information for 2017: 1. Net Income was $26,200. 2. Sales on account were $100,400. Sales returns and allowances amounted to $28,500. 3. Cost of goods sold was $225,300 4. Net cash provided by operating activities was $59.100. 5. Capital expenditures were $27.600, and cash dividends were $16,600 deurt rate and over to decimal places 1.8 and all other answers to I decimal Compute the following ratios at December 31, 2017. ( place . 1.8. Use 365 days for calculation) (a) Current ratio (1) Accounts receivable turnover times (c) Average collection period (d) Inventory turnover times (0) Days in inventory. Free cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts