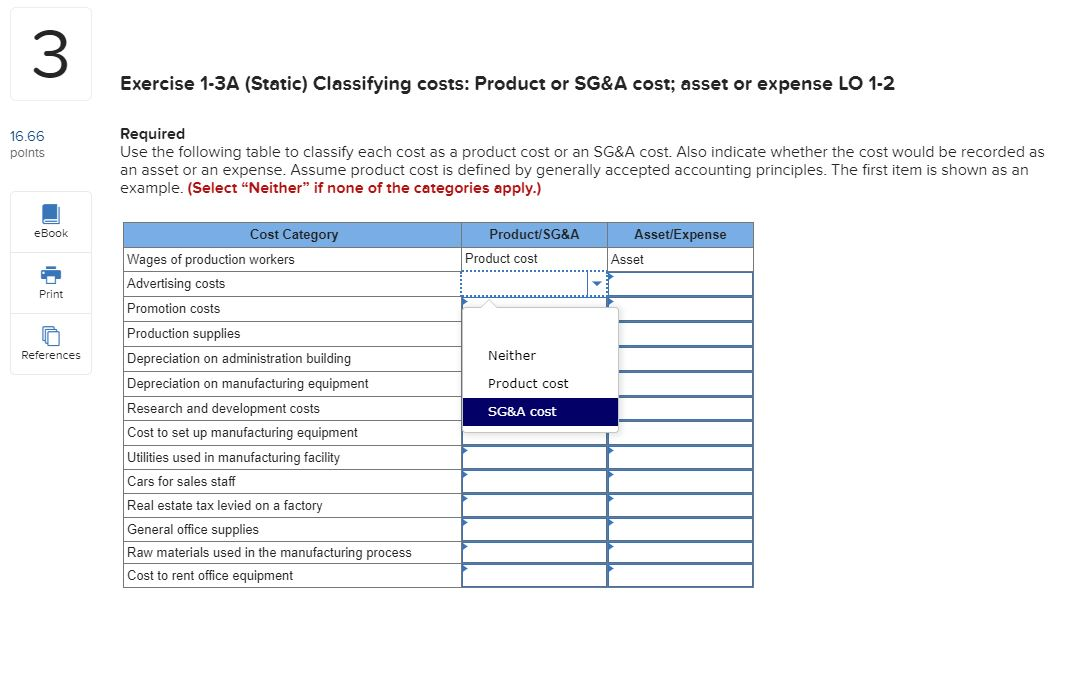

Question: Exercise 1-3A (Static) Classifying costs: Product or SG&A cost; asset or expense LO 1-2 16.66 points Required Use the following table to classify each cost

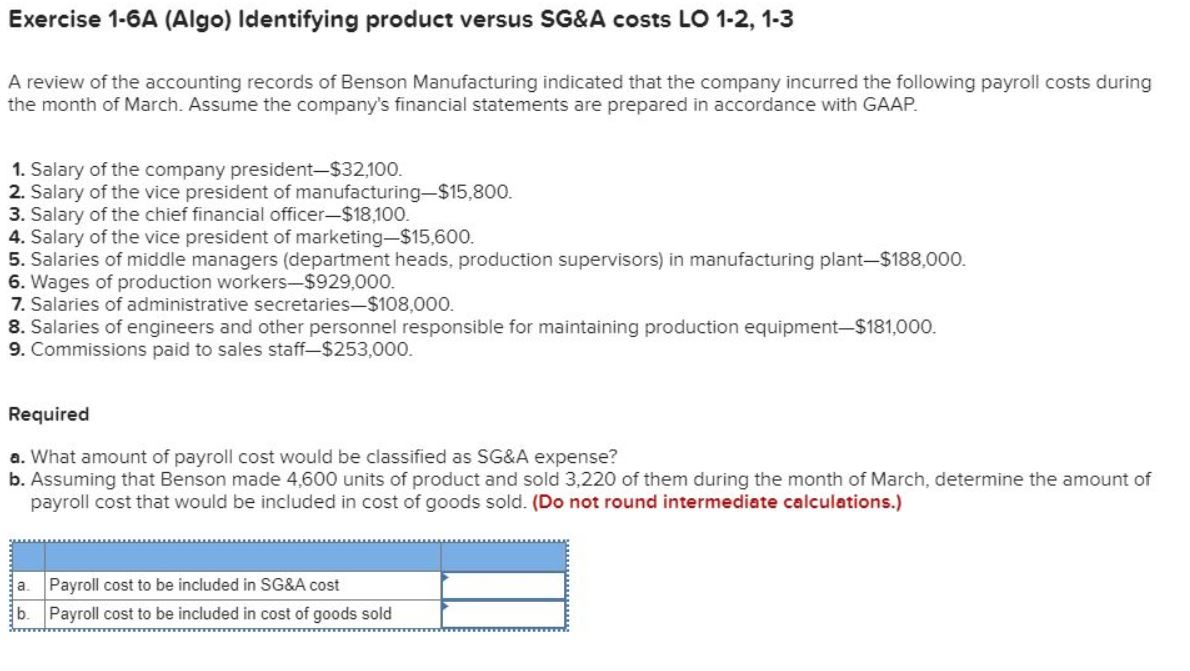

Exercise 1-3A (Static) Classifying costs: Product or SG&A cost; asset or expense LO 1-2 16.66 points Required Use the following table to classify each cost as a product cost or an SG&A cost. Also indicate whether the cost would be recorded as an asset or an expense. Assume product cost is defined by generally accepted accounting principles. The first item is shown as an example. (Select "Neither" if none of the categories apply.) eBook Asset/Expense Product/SG&A Product cost Asset Print References Neither Product cost Cost Category Wages of production workers Advertising costs Promotion costs Production supplies Depreciation on administration building Depreciation on manufacturing equipment Research and development costs Cost to set up manufacturing equipment Utilities used in manufacturing facility Cars for sales staff Real estate tax levied on a factory General office supplies Raw materials used in the manufacturing process Cost to rent office equipment SG&A cost Exercise 1-6A (Algo) Identifying product versus SG&A costs LO 1-2, 1-3 A review of the accounting records of Benson Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president-$32,100. 2. Salary of the vice president of manufacturing-$15,800. 3. Salary of the chief financial officer-$18,100. 4. Salary of the vice president of marketing-$15,600. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant-$188,000. 6. Wages of production workers-$929,000. 7. Salaries of administrative secretaries$108,000. 8. Salaries of engineers and other personnel responsible for maintaining production equipment-$181,000. 9. Commissions paid to sales staff-$253,000. Required a. What amount of payroll cost would be classified as SG&A expense? b. Assuming that Benson made 4,600 units of product and sold 3,220 of them during the month of March, determine the amount of payroll cost that would be included in cost of goods sold. (Do not round intermediate calculations.) a. Payroll cost to be included in SG&A cost b. Payroll cost to be included in cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Exercise 13A Classifying Costs Lets classify each cost according to whether it is a product cost SGA cost or neither Well also determine whether the cost is recorded as an asset or expense 1 Wages of ... View full answer

Get step-by-step solutions from verified subject matter experts