Answered step by step

Verified Expert Solution

Question

1 Approved Answer

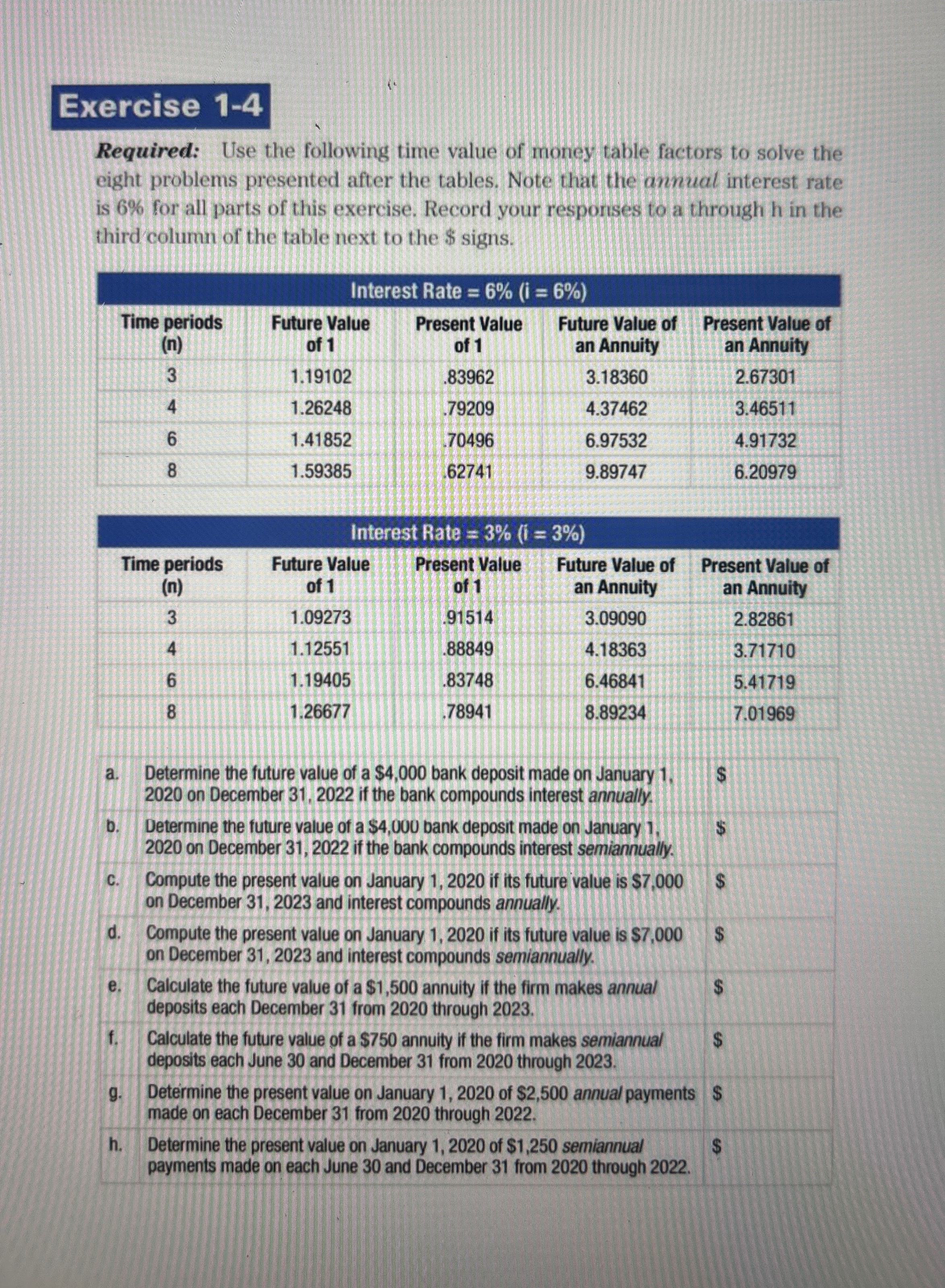

Exercise 1-4 Required: Use the following time value of money table factors to solve the eight problems presented after the tables. Note that the

Exercise 1-4 Required: Use the following time value of money table factors to solve the eight problems presented after the tables. Note that the annual interest rate is 6% for all parts of this exercise. Record your responses to a through h in the third column of the table next to the $ signs. Interest Rate = 6% (i = 6%) Time periods (n) Future Value Present Value Future Value of Present Value of 33 of 1 of 1 an Annuity an Annuity 1.19102 .83962 3.18360 2.67301 4 1.26248 .79209 4.37462 3.46511 6 1.41852 .70496 6.97532 4.91732 00 8 1.59385 .62741 9.89747 6.20979 Interest Rate = 3% (i =3%) Time periods Future Value Present Value Future Value of Present Value of (n) of 1 of 1 an Annuity an Annuity 3 1.09273 .91514 3.09090 2.82861 4 1.12551 .88849 4.18363 3.71710 68 1.19405 .83748 6.46841 5.41719 1.26677 .78941 8.89234 7.01969 S A a. b. C. Determine the future value of a $4,000 bank deposit made on January 1, 2020 on December 31, 2022 if the bank compounds interest annually. Determine the future value of a $4,000 bank deposit made on January 1, 2020 on December 31, 2022 if the bank compounds interest semiannually. Compute the present value on January 1, 2020 if its future value is $7,000 on December 31, 2023 and interest compounds annually. $ SA S d. Compute the present value on January 1, 2020 if its future value is $7,000 on December 31, 2023 and interest compounds semiannually. e. Calculate the future value of a $1,500 annuity if the firm makes annual deposits each December 31 from 2020 through 2023. $ f. Calculate the future value of a $750 annuity if the firm makes semiannual deposits each June 30 and December 31 from 2020 through 2023. $ g. Determine the present value on January 1, 2020 of $2,500 annual payments $ made on each December 31 from 2020 through 2022. h. Determine the present value on January 1, 2020 of $1,250 semiannual payments made on each June 30 and December 31 from 2020 through 2022. $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started