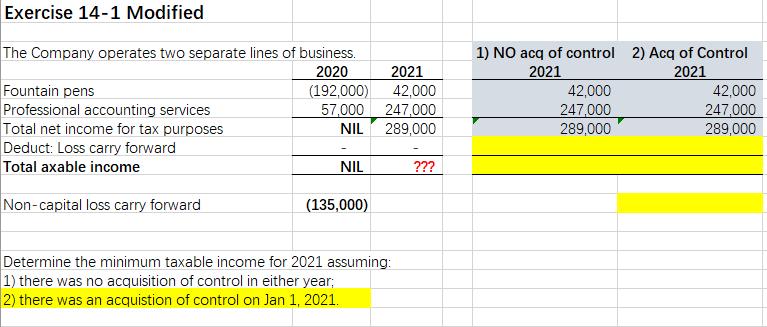

Question: Exercise 14-1 Modified The Company operates two separate lines of business. 2020 2021 Fountain pens (192,000) 42,000 57,000 247,000 Professional accounting services Total net

Exercise 14-1 Modified The Company operates two separate lines of business. 2020 2021 Fountain pens (192,000) 42,000 57,000 247,000 Professional accounting services Total net income for tax purposes Deduct: Loss carry forward NIL 289,000 Total axable income NIL ??? Non-capital loss carry forward (135,000) Determine the minimum taxable income for 2021 assuming: 1) there was no acquisition of control in either year; 2) there was an acquistion of control on Jan 1, 2021. 1) NO acq of control 2) Acq of Control 2021 2021 42,000 42,000 247,000 247,000 289,000 289,000

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

1 No Acquisition of control The year 2021 Net Income for Tax Purpose 289000 42000 247000 less No... View full answer

Get step-by-step solutions from verified subject matter experts