Question: Exercise 14-24 (Algorithmic) (LO. 2) Dexter owns a large tract of land and subdivides it for sale. Assume that Dexter meets all of the

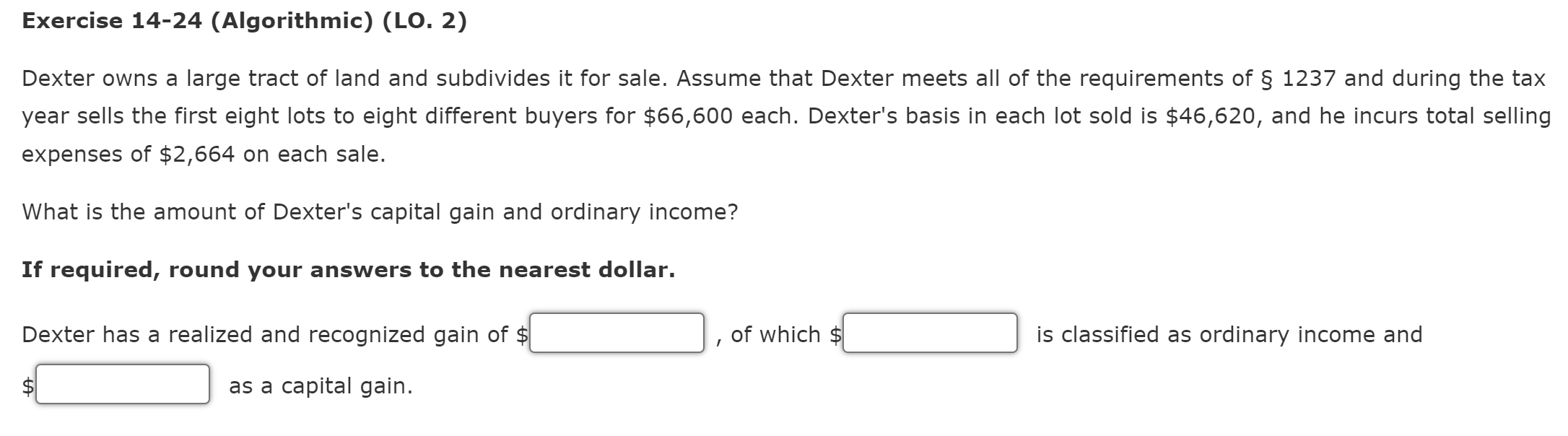

Exercise 14-24 (Algorithmic) (LO. 2) Dexter owns a large tract of land and subdivides it for sale. Assume that Dexter meets all of the requirements of 1237 and during the tax year sells the first eight lots to eight different buyers for $66,600 each. Dexter's basis in each lot sold is $46,620, and he incurs total selling expenses of $2,664 on each sale. What is the amount of Dexter's capital gain and ordinary income? If required, round your answers to the nearest dollar. Dexter has a realized and recognized gain of $ as a capital gain. of which $ is classified as ordinary income and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts