Question: Exercise 14-46 (Algo) Compare ROI Using Net Book and Gross Book Values (LO 14-2, 5) The Street Division of Labrosse Logistics just started operations. It

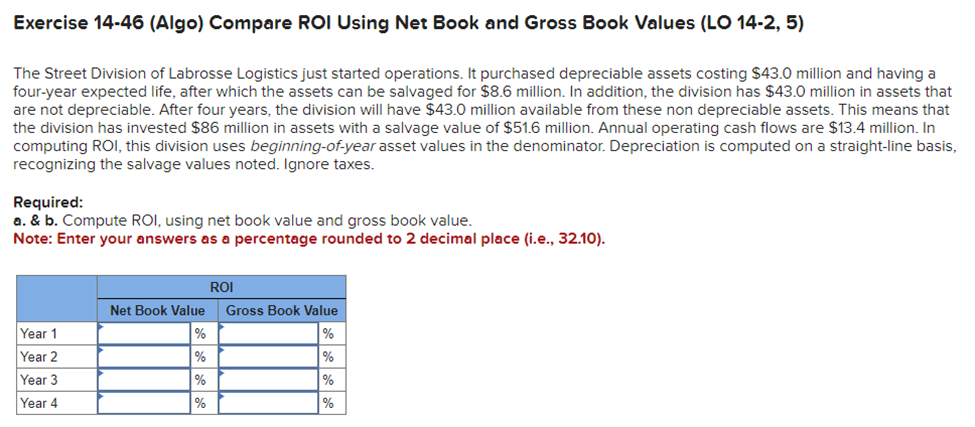

Exercise 14-46 (Algo) Compare ROI Using Net Book and Gross Book Values (LO 14-2, 5) The Street Division of Labrosse Logistics just started operations. It purchased depreciable assets costing $43.0 million and having a four-year expected life, after which the assets can be salvaged for $8.6 million. In addition, the division has $43.0 million in assets that are not depreciable. After four years, the division will have $43.0 million available from these non depreciable assets. This means that the division has invested $86 million in assets with a salvage value of $51.6 million. Annual operating cash flows are $13.4 million. In computing ROI, this division uses beginning-of-year asset values in the denominator. Depreciation is computed on a straight-line basis, recognizing the salvage values noted. Ignore taxes. Required: a. \& b. Compute ROI, using net book value and gross book value. Note: Enter your answers as a percentage rounded to 2 decimal place (i.e., 32.10)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts