Question: Exercise 14-46 (Algo) Compare ROI Using Net Book and Gross Book Values (LO 14-2,5) The Street Division of Labrosse Logistics just started operations. It purchased

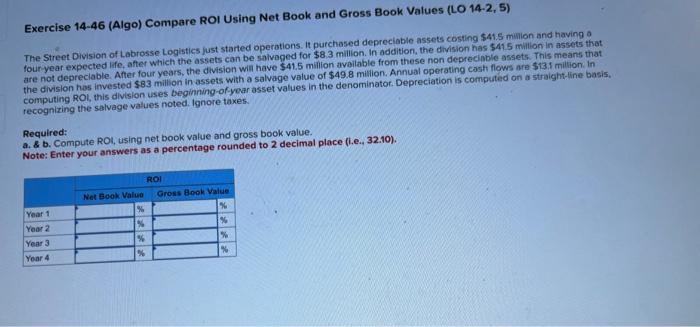

Exercise 14-46 (Algo) Compare ROI Using Net Book and Gross Book Values (LO 14-2,5) The Street Division of Labrosse Logistics just started operations. It purchased depreciabie assets costing $44.5m ilion and having 0 are not depreclable. After four years, the division will have $41.5 milion available from these non deprecioble assets. This means that the division has invested $83 million in assets with a salvage value of $49.8 milition. Annual operating cash flows are $13.1 miltion. in computing ROL, this division uses beginning-of-yoar asset values in the denominator. Depreciation is computed on a straight-line basis, recognizing the salvage values noted. Ignore taxes. Required: a. 8 b. Compute ROt, using net book value and gross book value. Note; Enter your answers as a percentage rounded to 2 decimal place (i.e., 32.10). Exercise 14-46 (Algo) Compare ROI Using Net Book and Gross Book Values (LO 14-2,5) The Street Division of Labrosse Logistics just started operations. It purchased depreciabie assets costing $44.5m ilion and having 0 are not depreclable. After four years, the division will have $41.5 milion available from these non deprecioble assets. This means that the division has invested $83 million in assets with a salvage value of $49.8 milition. Annual operating cash flows are $13.1 miltion. in computing ROL, this division uses beginning-of-yoar asset values in the denominator. Depreciation is computed on a straight-line basis, recognizing the salvage values noted. Ignore taxes. Required: a. 8 b. Compute ROt, using net book value and gross book value. Note; Enter your answers as a percentage rounded to 2 decimal place (i.e., 32.10)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts