Question: Exercise 1.5 - Monte-Carlo Valuation (Multi-Asset) Dynamics for two stocks, S1 and 52, are given below. S1 = S2 = 50 Rx = 3% T

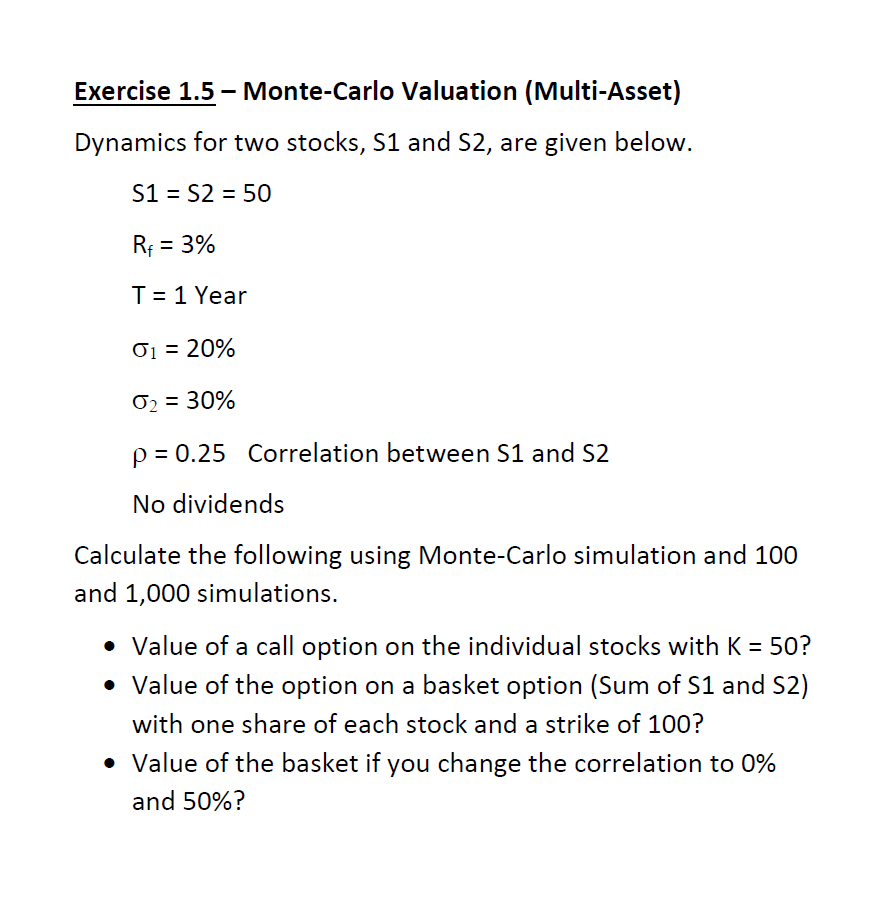

Exercise 1.5 - Monte-Carlo Valuation (Multi-Asset) Dynamics for two stocks, S1 and 52, are given below. S1 = S2 = 50 Rx = 3% T = 1 Year G1 = 20% 02 = 30% P = 0.25 Correlation between S1 and 52 No dividends = Calculate the following using Monte-Carlo simulation and 100 and 1,000 simulations. Value of a call option on the individual stocks with K = 50? Value of the option on a basket option (Sum of S1 and 52) with one share of each stock and a strike of 100? Value of the basket if you change the correlation to 0% and 50%? ? Exercise 1.5 - Monte-Carlo Valuation (Multi-Asset) Dynamics for two stocks, S1 and 52, are given below. S1 = S2 = 50 Rx = 3% T = 1 Year G1 = 20% 02 = 30% P = 0.25 Correlation between S1 and 52 No dividends = Calculate the following using Monte-Carlo simulation and 100 and 1,000 simulations. Value of a call option on the individual stocks with K = 50? Value of the option on a basket option (Sum of S1 and 52) with one share of each stock and a strike of 100? Value of the basket if you change the correlation to 0% and 50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts