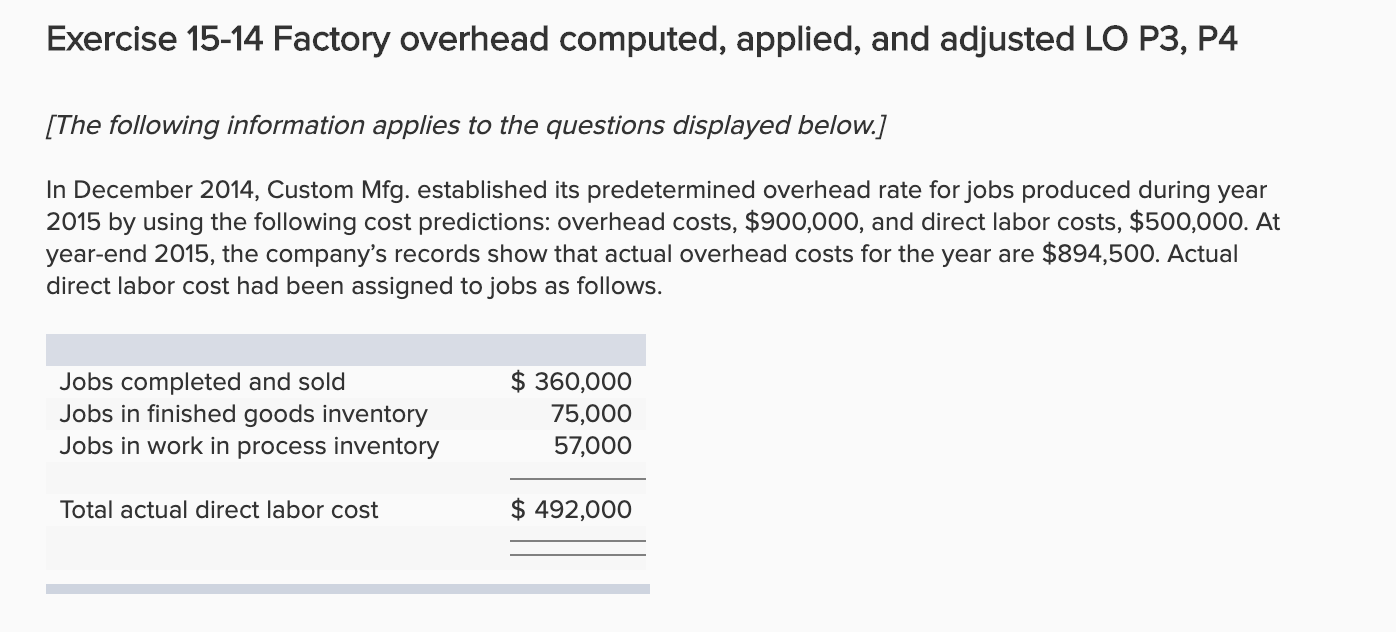

Question: Exercise 15-14 Factory overhead computed, applied, and adjusted LO P3, P4 [The following information applies to the questions displayed below.] In December 2014, Custom Mfg.

![[The following information applies to the questions displayed below.] In December 2014,](https://s3.amazonaws.com/si.experts.images/answers/2024/07/669a3c98abd05_088669a3c988e0f8.jpg)

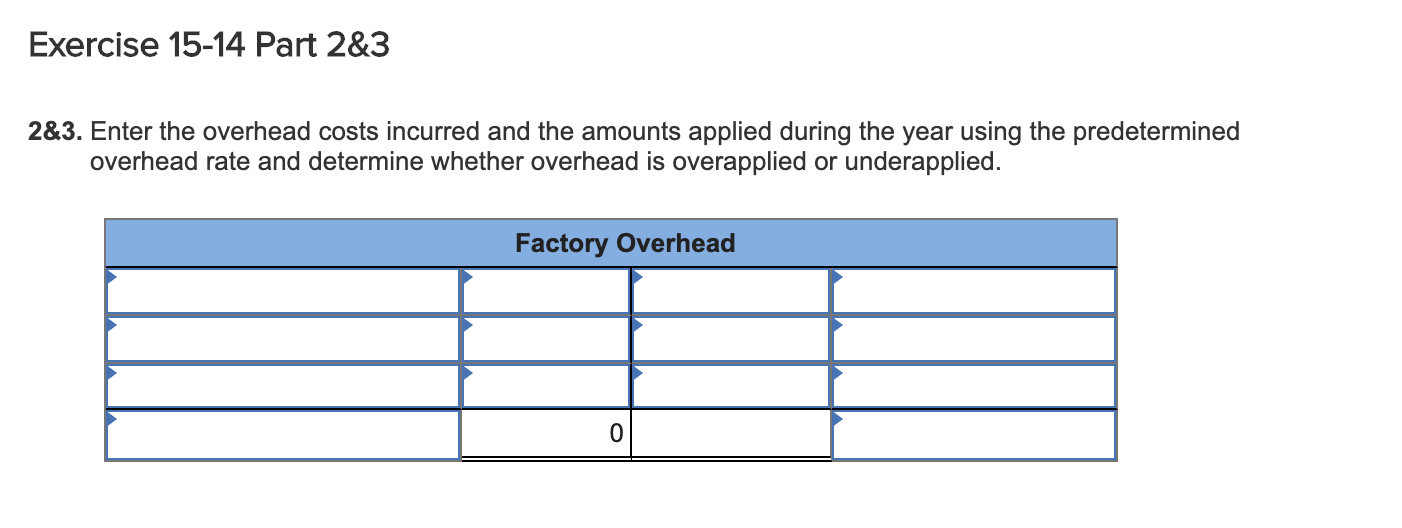

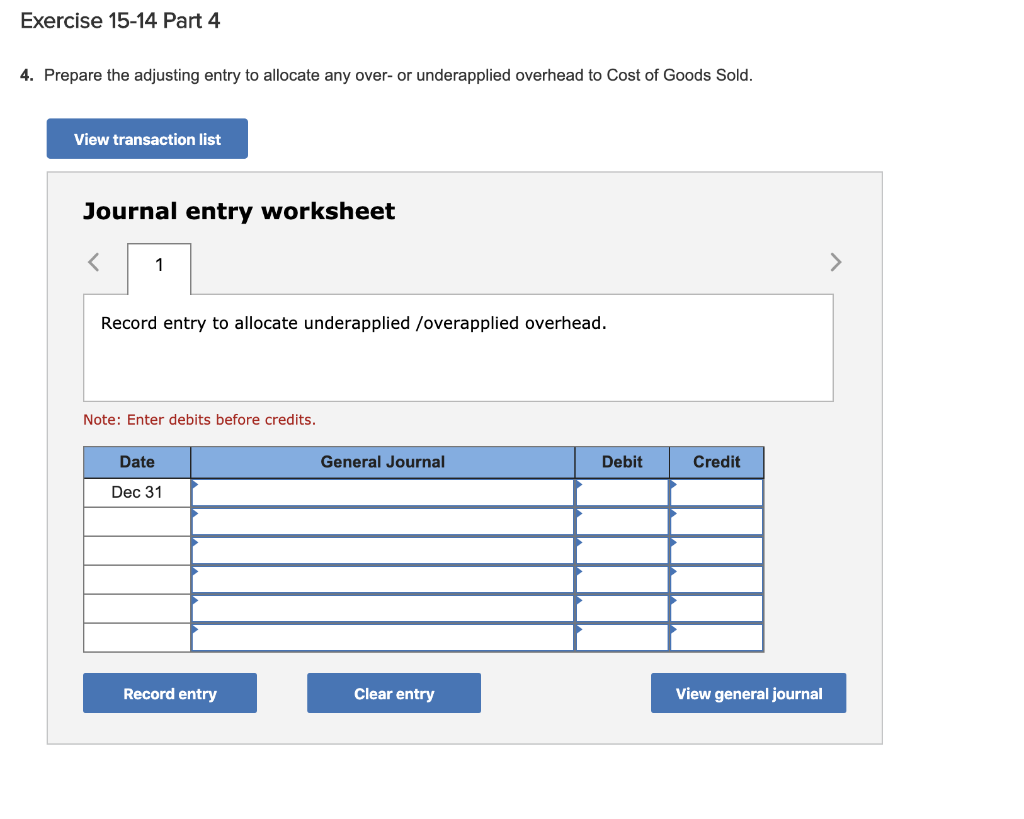

Exercise 15-14 Factory overhead computed, applied, and adjusted LO P3, P4 [The following information applies to the questions displayed below.] In December 2014, Custom Mfg. established its predetermined overhead rate for jobs produced during year 2015 by using the following cost predictions: overhead costs, $900,000, and direct labor costs, $500,000. At year-end 2015, the company's records show that actual overhead costs for the year are $894,500. Actual direct labor cost had been assigned to jobs as follows. Jobs completed and sold Jobs in finished goods inventory Jobs in work in process inventory $ 350,000 75,000 57,000 Total actual direct labor cost $ 492,000 Exercise 15-14 Part 1 1. Determine the predetermined overhead rate for year 2015. Overhead Rate Choose Denominator: Choose Numerator: | = Overhead Rate Overhead rate Il Exercise 15-14 Part 2&3 2&3. Enter the overhead costs incurred and the amounts applied during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied. Factory Overhead | 0 Exercise 15-14 Part 4 4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold. View transaction list Journal entry worksheet Record entry to allocate underapplied /overapplied overhead. Note: Enter debits before credits. General Journal Debit Credit Date Dec 31 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts