Question: Exercise 15-15 (LO. 3, 4) Robert is the sole shareholder and CEO of ABC, Inc., an S corporation that is a qualified trade or business.

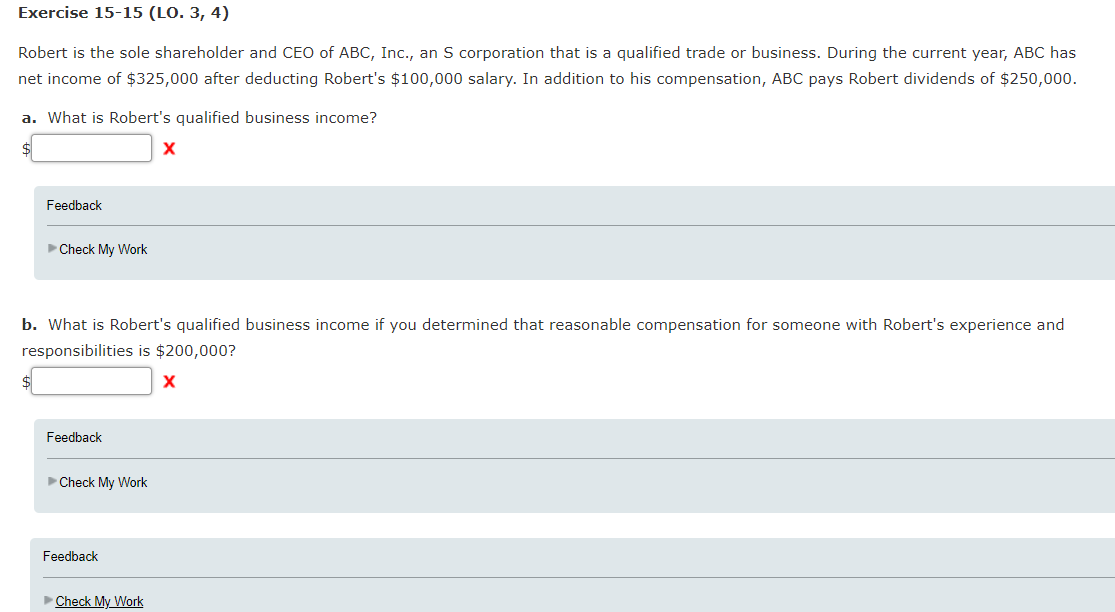

Exercise 15-15 (LO. 3, 4) Robert is the sole shareholder and CEO of ABC, Inc., an S corporation that is a qualified trade or business. During the current year, ABC has net income of $325,000 after deducting Robert's $100,000 salary. In addition to his compensation, ABC pays Robert dividends of $250,000. a. What is Robert's qualified business income? Feedback Check My Work b. What is Robert's qualified business income if you determined that reasonable compensation for someone with Robert's experience and responsibilities is $200,000? Feedback Check My Work Feedback Check My Work

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock