Question: Exercise 15-22 (Algorithmic) (LO. 4) Jamil, who is single, sold his principal residence on April 10, 2020, and excluded the realized gain under $ 121

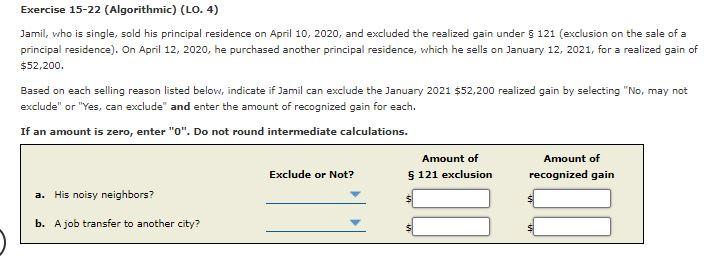

Exercise 15-22 (Algorithmic) (LO. 4) Jamil, who is single, sold his principal residence on April 10, 2020, and excluded the realized gain under $ 121 (exclusion on the sale of a principal residence). On April 12, 2020, he purchased another principal residence, which he sells on January 12, 2021, for a realized gain of $52,200. Based on each selling reason listed below, indicate if Jamil can exclude the January 2021 $52,200 realized gain by selecting "No, may not exclude" or "Yes, can exclude" and enter the amount of recognized gain for each. If an amount is zero, enter "0". Do not round intermediate calculations. Amount of Amount of Exclude or Not? recognized gain a. His noisy neighbors? $ 121 exclusion b. A job transfer to another city

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts