Question: Exercise 16-13 Calculating cash flows from operating activities (direct and indirect methods) LO5, 7 Use the following income statement and Information about changes in non-cash

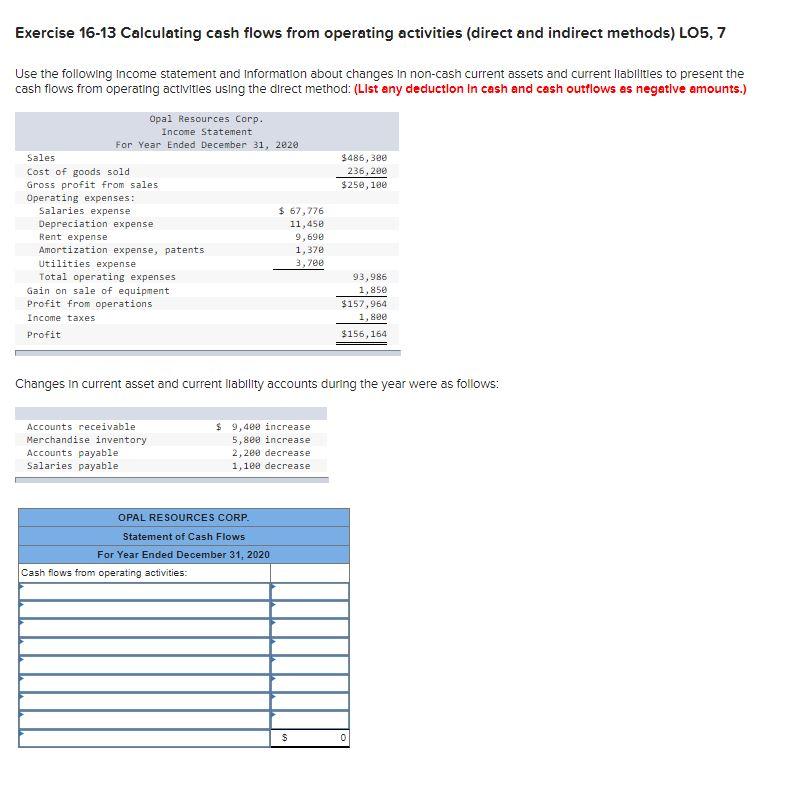

Exercise 16-13 Calculating cash flows from operating activities (direct and indirect methods) LO5, 7 Use the following income statement and Information about changes in non-cash current assets and current liabilities to present the cash flows from operating activities using the direct method: (List any deduction In cash and cash outflows as negative amounts.) $486, 380 236, 280 $250, 180 Opal Resources Corp. Income Statement For Year Ended December 31, 2020 Sales Cost of goods sold Gross profit from sales Operating expenses: Salaries expense $ 67,776 Depreciation expense 11,450 Rent expense 9,690 Amortization expense, patents 1,370 Utilities expense 3,78e Total operating expenses Gain on sale of equipment Profit from operations Income taxes Profit 93,986 1,85e $157,964 1,800 $156,164 Changes in current asset and current liability accounts during the year were as follows: Accounts receivable Merchandise inventory Accounts payable Salaries payable $ 9,488 increase 5,888 increase 2,288 decrease 1,108 decrease OPAL RESOURCES CORP. Statement of Cash Flows For Year Ended December 31, 2020 Cash flows from operating activities: 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts