Question: Exercise 16-4 Indirect: Cash flows from operating activities LO P2 The following income statement and information about changes in noncash current assets and current liabilities

Exercise 16-4 Indirect: Cash flows from operating activities LO P2

The following income statement and information about changes in noncash current assets and current liabilities are reported.

| Sales | $1,627,000 | |

|---|---|---|

| Cost of goods sold | 797,230 | |

| Gross profit | 829,770 | |

| Operating expenses | ||

| Salaries expense | $222,899 | |

| Depreciation expense | 39,048 | |

| Rent expense | 43,929 | |

| Amortization expensesPatents | 4,881 | |

| Utilities expense | 17,897 | 328,654 |

| 501,116 | ||

| Gain on sale of equipment | 6,508 | |

| Net income | $507,624 | |

Changes in current asset and current liability accounts for the year that relate to operations follow.

| Accounts receivable | $38,700 | increase | Accounts payable | $13,875 | decrease |

| Inventory | 35,200 | increase | Salaries payable | 3,400 | decrease |

Required:

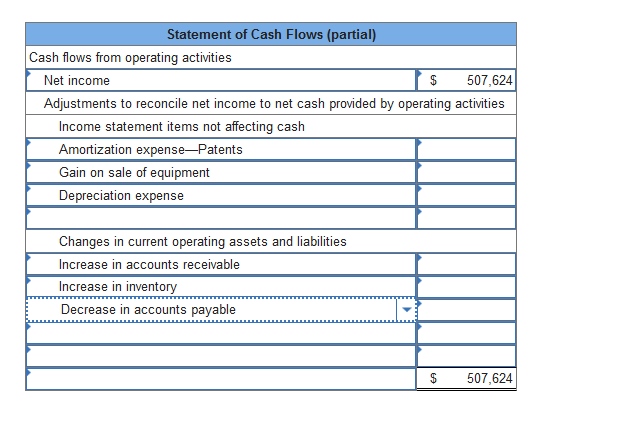

Prepare only the cash flows from operating activities section of the statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)

Statement of Cash Flows (partial) Cash flows from operating activities Net income $ 507,624 Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Amortization expense-Patents Gain on sale of equipment Depreciation expense Changes in current operating assets and liabilities Increase in accounts receivable Increase in inventory Decrease in accounts payable $ 507,624

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts