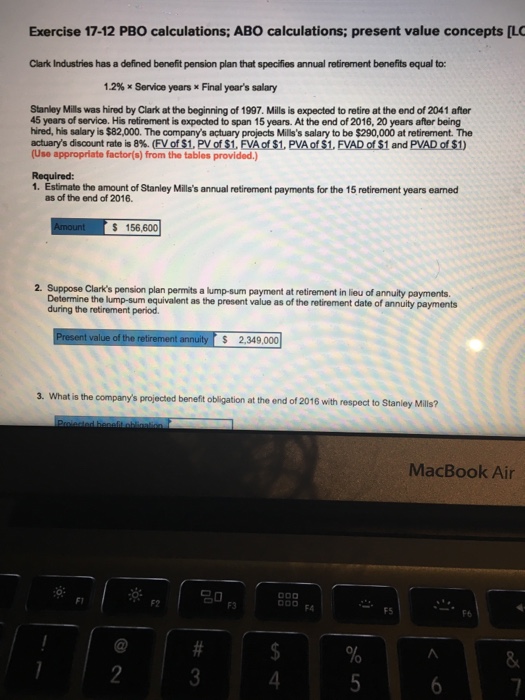

Question: Exercise 17-12 PBO calculations; ABO calculations; present value concepts [L Clark Industries has a defined benefit pension plan that specifies annual retirement benefits equal to:

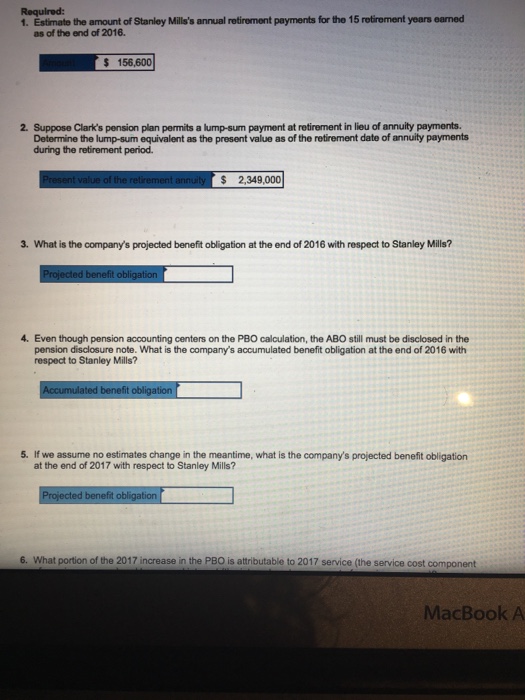

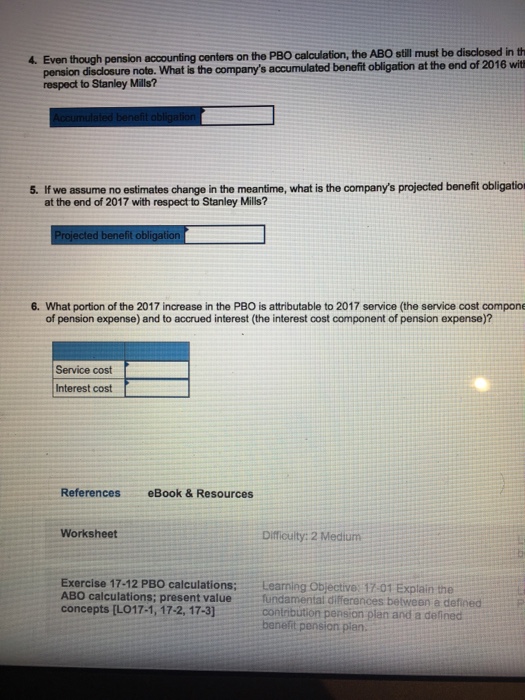

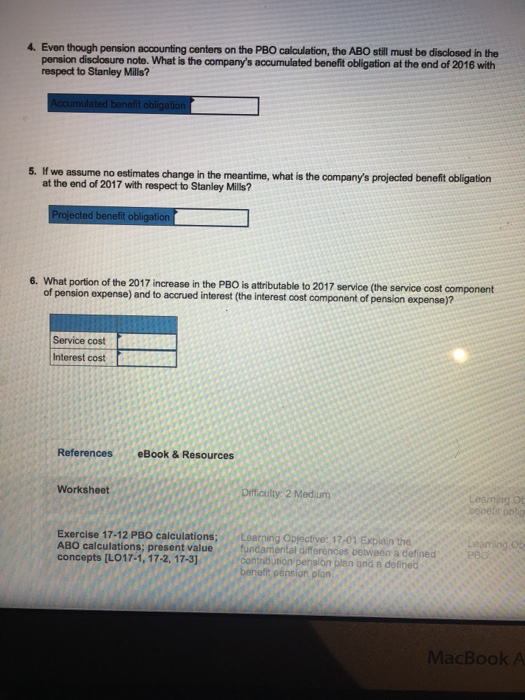

Exercise 17-12 PBO calculations; ABO calculations; present value concepts [L Clark Industries has a defined benefit pension plan that specifies annual retirement benefits equal to: 1.2% x Service years x Final year's salary Stanley Mills was hired by Clark at the beginning of 1997. Mills is expected to retire at the end of 2041 after 45 years of service. His retirement is expected to span 15 years. At the end of 2016, 20 years after being hired, his salary is $82,000. The company's actuary projects Mills's salary to be $290,000 at retirement. The actuary's discount rate is 8%. (FVof$1. Pyofs1. EVAofS1. PVAofS1. EVADofS1 and P ADofSD (Use appropriate factors) from the tables provided.) Required: 1. Estrmate amount of Stanley Mill's anual retirerment payments for the 15 retrement yeers earmed the S 156,600 2. Suppose Clark's pension plan permits a lump-sum payment at retirement in lieu of annuity payments. Determine the lump-sum equivalent as the present value as of the retirement date of annuity payments during the retirement period. t value of the retirement annuity 2,349,000 3. What is the company's projected beneft obligation at the end of 2016 with respect to Stanley Mills? MacBook Air FI F2 F4 FS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts