Question: Exercise 17.3 #4 A small regional airline has narrowed down the possible choices for its next passenger plane purchase to two alternatives. The Eagle model

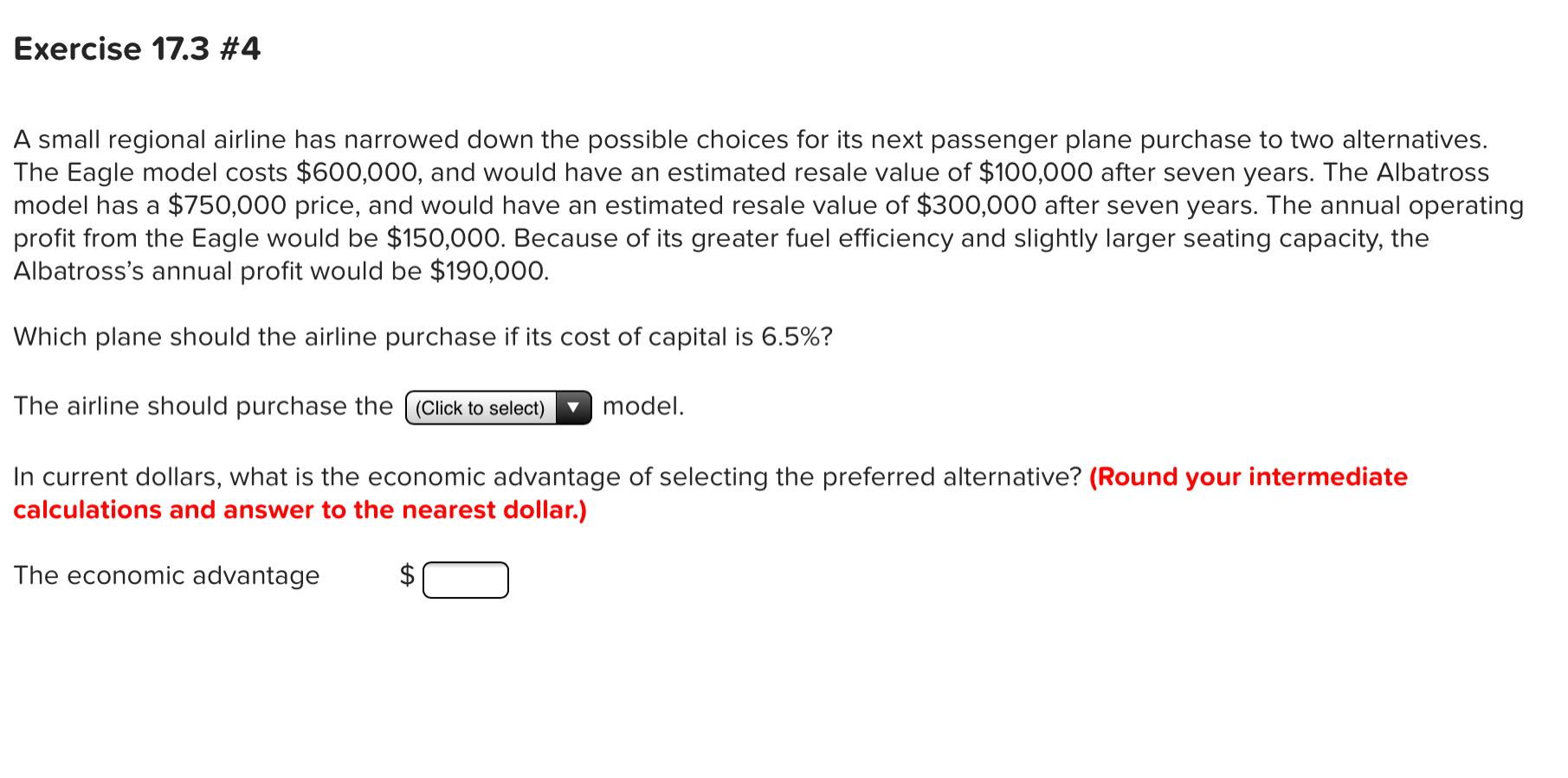

Exercise 17.3 #4 A small regional airline has narrowed down the possible choices for its next passenger plane purchase to two alternatives. The Eagle model costs $600,000, and would have an estimated resale value of $100,000 after seven years. The Albatross model has a $750,000 price, and would have an estimated resale value of $300,000 after seven years. The annual operating profit from the Eagle would be $150,000. Because of its greater fuel efficiency and slightly larger seating capacity, the Albatross's annual profit would be $190,000. Which plane should the airline purchase if its cost of capital is 6.5%? The airline should purchase the ((Click to select) model. In current dollars, what is the economic advantage of selecting the preferred alternative? (Round your intermediate calculations and answer to the nearest dollar.) The economic advantage ta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts