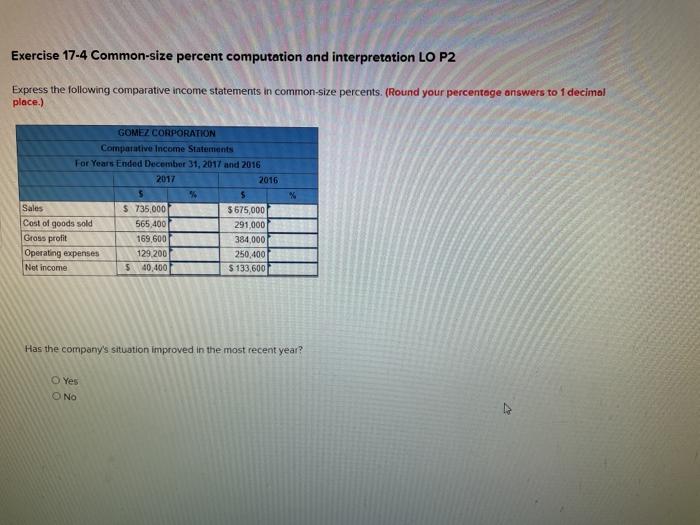

Question: Exercise 17-4 Common-size percent computation and interpretation LO P2 Express the following comparative income statements in common-size percents. (Round your percentage answers to 1 decimal

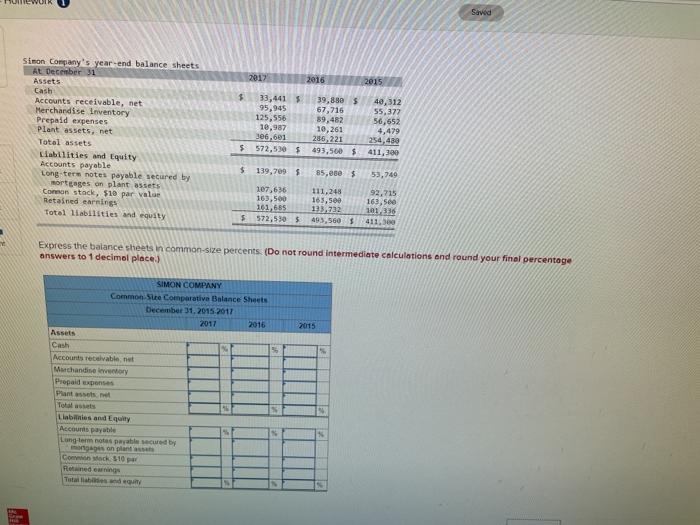

Exercise 17-4 Common-size percent computation and interpretation LO P2 Express the following comparative income statements in common-size percents. (Round your percentage answers to 1 decimal place.) X GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31, 2017 and 2016 2017 2016 % $ $ 735,000 5675,000 Cost of goods sold 565,400 291,000 Gross profit 169,600 384,000 Operating expenses 129 200 250,400 Net income $ 40,400 $ 133.600 Sales Has the company's situation improved in the most recent year? Yes ONO VOIR Saved 2012 2016 2015 Simon Company's year end balance sheets At December 31 Assets Cash Accounts receivable, net Merchandise Inventory Prepaid expenses plant assets, net Total assets Liabilities and Equity Accounts payable Long term notes payable secured by mortgages on plant assets Coron stack, $10 par value Retained earning Total liabilities and equity $ 33,4415 95,945 125,556 10,987 306,601 $ 572,530 5 39,8805 67,716 89,482 10,261 286,221 493,500 $ 40,312 55.377 56,652 4,479 254.489 411,300 $ 139.705 5 85,000 $ 53,740 107,636 163,500 101,655 572,5305 111.248 163,500 123,732 493,5605 92,215 163,5 101 336 411,300 5 Express the balance sheets in common-size percents. (Do not round Intermediate calculations and round your final percentage answers to 1 decimol place) 2015 SIMON COMPANY Common Ste Comparative Balance Sheets December 31, 2015 2017 2017 2016 Assets Cash Accounts receivable.net Marchandise wory Prepaid expenses Plants Labies and Equity Accounts payable Longtem notas payabled by Coack $10 Rendering Total de

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts