Question: Exercise 19-23 (Algorithmic) (LO. 4, 10) Rover Corporation would like to transfer excess cash to its sole shareholder, Aleshia, who is also an employee. Aleshia

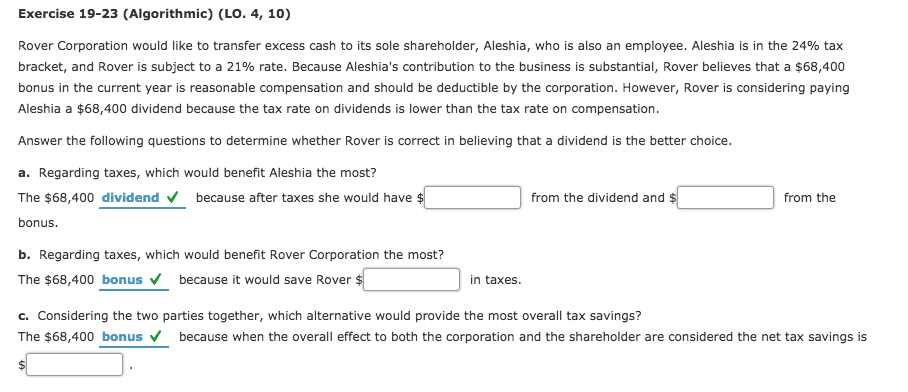

Exercise 19-23 (Algorithmic) (LO. 4, 10) Rover Corporation would like to transfer excess cash to its sole shareholder, Aleshia, who is also an employee. Aleshia is in the 24% tax bracket, and Rover is subject to a 21% rate. Because Aleshia's contribution to the business is substantial, Rover believes that a S58.400 bonus in the current year is reasonable compensation and should be deductible by the corporation. However, Rover is considering paying Aleshia a $68,400 dividend because the tax rate on dividends is lower than the tax rate on compensation. Answer the following questions to determine whether Rover is correct in believing that a dividend is the better choice a. Regarding taxes, which would benefit Aleshia the most? The $68,400 dividend because after taxes she would have bonus from the dividend and from the b. Regarding taxes, which would benefit Rover Corporation the most? The $68,400 bonus because it would save Rover $ in taxes. c. Considering the two parties together, which alternative would provide the most overall tax savings? The $68,400 bonusbecause when the overall effect to both the corporation and the shareholder are considered the net tax savings is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts