Question: Exercise 21-16 Crede Inc. has two divisions. Division A makes and sells student desks. Division B manufactures and sells reading lamps. Each desk has a

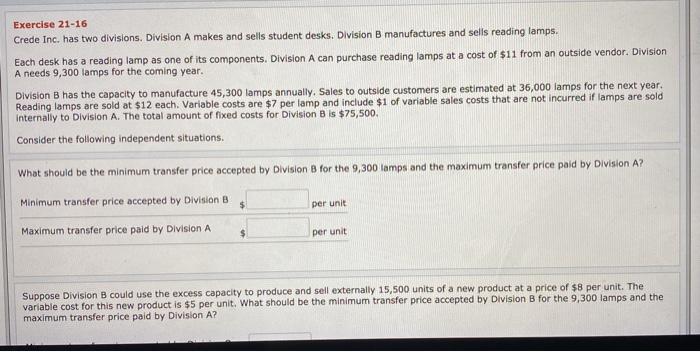

Exercise 21-16 Crede Inc. has two divisions. Division A makes and sells student desks. Division B manufactures and sells reading lamps. Each desk has a reading lamp as one of its components. Division A can purchase reading lamps at a cost of $11 from an outside vendor. Division A needs 9,300 lamps for the coming year. Division B has the capacity to manufacture 45,300 lamps annually. Sales to outside customers are estimated at 36,000 lamps for the next year. Reading lamps are sold at $12 each. Variable costs are $7 per lamp and include $1 of variable sales costs that are not incurred if lamps are sold Internally to Division A. The total amount of fixed costs for Division B is $75,500. Consider the following independent situations. What should be the minimum transfer price accepted by Division B for the 9,300 lamps and the maximum transfer price paid by Division A? Minimum transfer price accepted by Division B Maximum transfer price paid by Division A $ per unit per unit Suppose Division B could use the excess capacity to produce and sell externally 15,500 units of a new product at a price of $8 per unit. The variable cost for this new product is $5 per unit. What should be the minimum transfer price accepted by Division B for the 9,300 lamps and the maximum transfer price paid by Division A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts