Question: Exercise 21-20 (c) (LO. 8) When Austin Development LLC was formed, Michelle contributed land (value of $1,800,000 and basis of $600,000), and Chadwick contributed cash

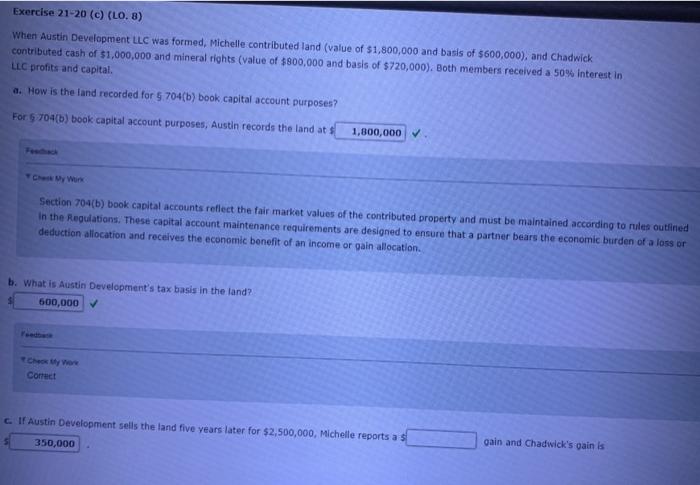

Exercise 21-20 (c) (LO. 8) When Austin Development LLC was formed, Michelle contributed land (value of $1,800,000 and basis of $600,000), and Chadwick contributed cash of $1,000,000 and mineral rights (value of $800,000 and basis of $720,000). Both members received a 50% interest in LIC profits and capital a. How is the land recorded for $704(b) book capital account purposes? For $ 704(b) book capital account purposes, Austin records the land ats 1,800,000 Section 704(b) book capital accounts reflect the fair market values of the contributed property and must be maintained according to rules outlined In the Regulations. These capital account maintenance requirements are designed to ensure that a partner bears the economic burden of a loss or deduction allocation and receives the economic benefit of an income or gain allocation. b. What is Austin Development's tax basis in the land? 600,000 Correct c. If Austin Development sells the land five years later for $2,500,000, Michelle reports as 350,000 gain and Chadwick's gain is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts