Question: Exercise 2.2: Suppose that preferences are given by the utility function u(c, l) = ln(c) + ? ln(l), where ? > 0 is a preference

Exercise 2.2: Suppose that preferences are given by the utility function u(c, l) =

ln(c) + ? ln(l), where ? > 0 is a preference parameter. For these preferences,

one can demonstrate that MRS(c, l) = ?c/l. Use this information, together

with the conditions in (11) to solve explicitly for consumer demand, the demand

for leisure and (from the time constraint) the supply of labor.

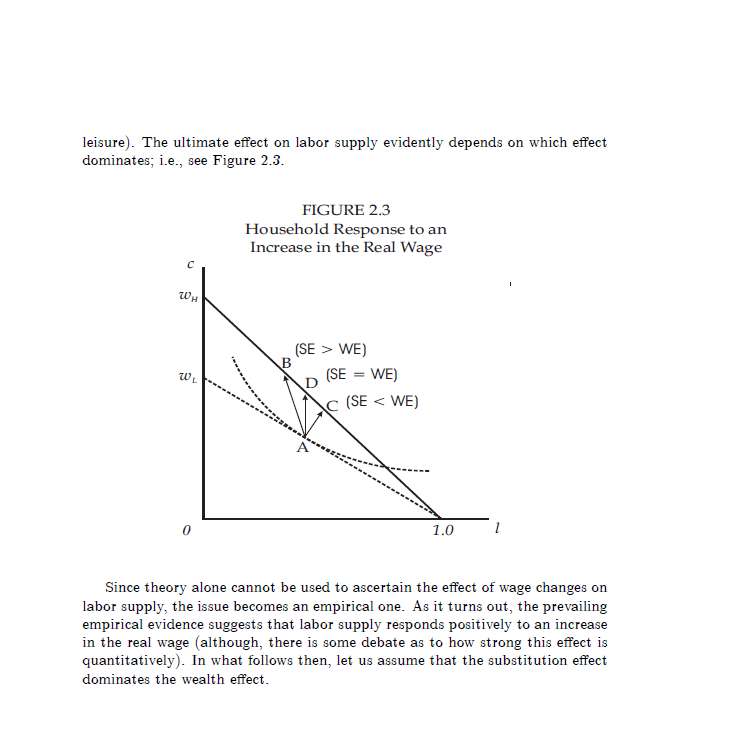

of labor, n5 = 1 I\". In terms of a diagram, the optimal choice is displayed in Figure 2.2 as allocation A [This gure is drawn for the case in which :1 = 0). FIGURE 2.2 Household Che ice Budget Line to r: = w 191' C Figure 2.? contains several pieces of information. First note that the budget line {the combinations of c and I. that exhaust the available budget} is linear, with a slope equal to w and a yintercept equal to w + d (with d = I] here). The yintercept indicates the maximum amount of consumption that is budget feasible, given the prevailing real wage in. In principle, allocations such as point B are also budget feasible, but they are not optimal. That is, allocation A is preferred to B and is a'ordable. An allocation like C is preferred to A, but note that allocation 0 is not aordahle. The best that the household can do, given the prevailing wage 10', is to choose an allocation like A. As it turns out, we can describe the optimal allocation mathematically. In particular, one can prove that only allocation A satises the following two con ditions at the same time: MRS(CD,D} w; (11) a\" + on!\" = w + d. The rst condition states that, at the optimal allocation, the slope of the in difference curve must equal the slope of the budget line. The second condition states that the optimal allocation must lie on the budget line. Only the alloca tion at point A satises these two conditions simultaneously. Exercise 2.1: Using a diagram similar to Figure 2.2, identify an allocation that satises ltd-RS = w, but is not on the budget Line. Can such an allocation be optimal? Now identify an allocation that is on the budget line, but where MR5 75 w. Can such an allocation be optimal? Explain. Notice that since we have assumed that the household makes its choice con- ditional on some prevailing pattern of wages and dividends (in, d), it follows that the optimal choice will, in general, depend on these parameters. At times, we may wish to emphasize this dependence by writing the solution explicitly as a function of the underlying parameters; e.g., cD(w,d}, ID (in, d) and n5(w, d). Exercise 2.2: Suppose that preferences are given by the utility function Etc,\" = ln(c) + )| In\"), where /\\ )- 0 is a preference parameter. For these preferences, one can demonstrate that MRS(C,) = Ach Use this information, together with the conditions in {11] to solve explicitly for consumer demand, the demand for leisure and (from the time constraint) the supplyr of labor. The theory developed here makes clear that the allocation of time to market work (the supply of labor) should depend on the return to work relative other potential uses of time [in this simple model, leisure is the only alternative). The return to work here is given by the real wage. Intuitively, one would expect that an exogenous increase in the real wage might lead a household to reduce its demand for leisure [and hence, increase labor supply). \"While this intuition is not incorrect, it needs to be qualied. we can discover how by way of a simple diagram. Figure 2.3 depicts how a household's desired behavior may change with an increase in the return to labor. Let allocation A in Figure 2.3 depict desired behavior for a low real wage, my, Now, imagine that the real wage rises to mg ) 19L. Figure 2.3 (again, drawn for the case in which at = 0) shows that the household may respond in three general ways, represented by the alloca tions 13,0, and D. In each of these cases, consumer demand is predicted to rise. However, the e'ect on labor supply is, in general, ambiguous. Why is this the case? An increase in the real wage has two effects on the household budget. First, the price of leisure [relative to consumption} increases. Our intuition sug gests that households will respond to this price change by substituting into the cheaper commodity (i.e_, from leisure into consumption, with the implied increase in labor supply). This is called the substitution effect. Second, household wealth [measured in units of output) increases. Recall that both con sumption and leisure are assumed to be normal goods. The logic of the model therefore implies that the demand for both consumption and leisure should rise along with wealth with the increase in leisure coming at the expense of labor. This is called the wealth effect. Both of these efl'ects work in the same di rection for consumption [which is why consumer demand must rise). However, these e'ects work in opposite directions for labor supply (or the demand for leisure]. The ultimate effect on labor supply evidently depends on which effect dominates; i_e_, see Figure 2.3. FIGURE 2.3 Household Response to an Increase in the Real Wage _ [SE > WE] Since theory alone cannot be used to ascertain the effect of wage changes on labor supply, the issue becomes an empirical one. As it turns out, the prevailing empirical evidence suggests that labor supply responds positively to an increase in the real wage (although, there is some debate as to how strong this e'ect is quantitatively}. In what follows then, let us assume that the substitution effect dominates the wealth e'ect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts