Question: Exercise 23-10 (Algorithmic) (LO. 3) Helpers, Inc., a qualifving 501 (c)(3) organization, incurs lobbying expenditures of $290,250 for the taxable year and grass roots expenditures

Exercise 23-10 (Algorithmic) (LO. 3)

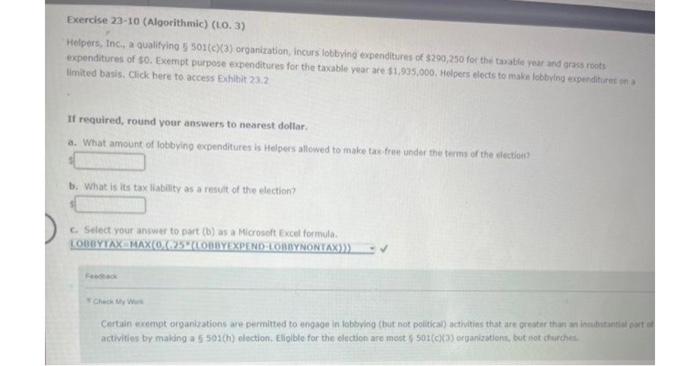

Helpers, Inc., a qualifving 501 (c)(3) organization, incurs lobbying expenditures of $290,250 for the taxable year and grass roots expenditures of $0. Exempt purpose expenditures for the taxable year are $1,935,000. Helpers elects to make lobbying expenditures on a limited basis. Click here to access Exhibit 23.2

If required, round your answers to nearest dollar.

- What amount of lobbying expenditures is Helpers allowed to make tax-free under the terms of the election?

- What is its tax liability as a result of the election?

Exercise 23-10 (Aloorithmic) (10,3) Helpers, Inc, a qualifyino 5,301(c)(3) organitation, incursilobbying expenditures of 3290,250 for the tayable near and arks roots. expenditures of te. Exempt purpose expenditures for the taxable year are 51,935,000, Hedpers docts to make lobbylny experditirer in . limited basis. Click bere to access Eihibit 23.2. If required, round vour answers to nearest dollar. a. What amount of lobbying ecpenditures is Helpers allowed to make tax fret under the terms of the silection!? b. What is its tax liability as a resuit of the election? C. Select your answer to part (b) as a Microseft Excel formula. o cheth Mry Wur Certain exempt organizations are permilted to engaoe in lobbving (but not politica) activitins that are greater than m innbutintiat ext i antivities by making a 5501(h) election, Eliolble for the olection are mest: 501(c)0) erganizatiens, but mot ifurchei. Exercise 23-10 (Aloorithmic) (10,3) Helpers, Inc, a qualifyino 5,301(c)(3) organitation, incursilobbying expenditures of 3290,250 for the tayable near and arks roots. expenditures of te. Exempt purpose expenditures for the taxable year are 51,935,000, Hedpers docts to make lobbylny experditirer in . limited basis. Click bere to access Eihibit 23.2. If required, round vour answers to nearest dollar. a. What amount of lobbying ecpenditures is Helpers allowed to make tax fret under the terms of the silection!? b. What is its tax liability as a resuit of the election? C. Select your answer to part (b) as a Microseft Excel formula. o cheth Mry Wur Certain exempt organizations are permilted to engaoe in lobbving (but not politica) activitins that are greater than m innbutintiat ext i antivities by making a 5501(h) election, Eliolble for the olection are mest: 501(c)0) erganizatiens, but mot ifurchei

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts