Question: Exercise 15-10 (Algorithmic) (LO. 3) Helpers, Inc., a qualifying $ 501(c)(3) organization, incurs lobbying expenditures of $266,250 for the taxable year and grass roots expenditures

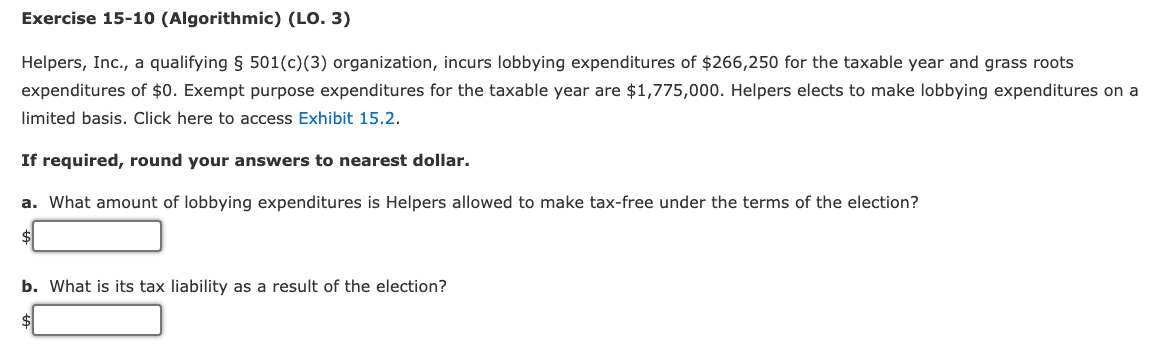

Exercise 15-10 (Algorithmic) (LO. 3) Helpers, Inc., a qualifying $ 501(c)(3) organization, incurs lobbying expenditures of $266,250 for the taxable year and grass roots expenditures of $0. Exempt purpose expenditures for the taxable year are $1,775,000. Helpers elects to make lobbying expenditures on a limited basis. Click here to access Exhibit 15.2. If required, round your answers to nearest dollar. a. What amount of lobbying expenditures is Helpers allowed to make tax-free under the terms of the election? $ b. What is its tax liability as a result of the election

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts