Question: Exercise 23-12 (Algorithmic) (LO. 5) Rejoice, Inc., a private foundation, has existed for 10 years. Rejoice held undistributed income of $274,400 at the end of

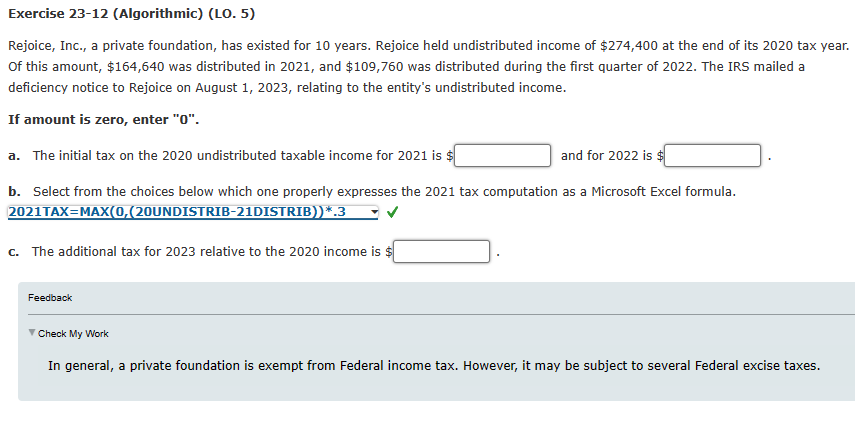

Exercise 23-12 (Algorithmic) (LO. 5) Rejoice, Inc., a private foundation, has existed for 10 years. Rejoice held undistributed income of $274,400 at the end of its 2020 tax year. Of this amount, $164,640 was distributed in 2021 , and $109,760 was distributed during the first quarter of 2022 . The IRS mailed a deficiency notice to Rejoice on August 1, 2023, relating to the entity's undistributed income. If amount is zero, enter " 0 ". a. The initial tax on the 2020 undistributed taxable income for 2021 is $ and for 2022 is $ b. Select from the choices below which one properly expresses the 2021 tax computation as a Microsoft Excel formula. c. The additional tax for 2023 relative to the 2020 income is $ Feedback Theck My Work In general, a private foundation is exempt from Federal income tax. However, it may be subject to several Federal excise taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts