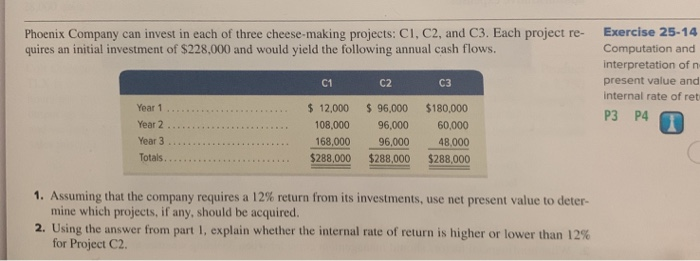

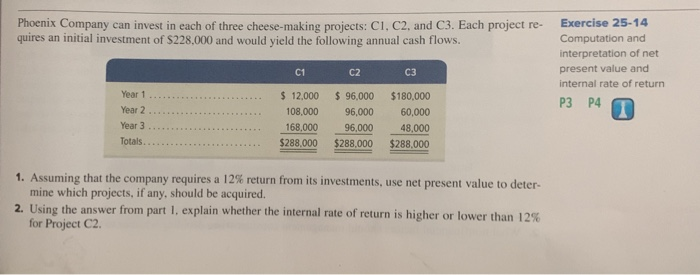

Question: Exercise 25-14 Computation and interpretation of n present value and internal rate of ret P3 P4 Phoenix Company can invest in each of three cheese-making

Exercise 25-14 Computation and interpretation of n present value and internal rate of ret P3 P4 Phoenix Company can invest in each of three cheese-making projects: CI, C2, and C3. Each project re- quires an initial investment of $228,000 and would yield the following annual cash flows. C1 C3 C2 Year 1 $12,000 96,000 $180,000 08,000 96,000 60,000 168,00096,00048,000 Totals 1. Assuming that the company requires a 12% return from its investments, use net present value to deter- mine which projects, if any, should be acquired. 2. Using the answer form part l explain whether the internal rate of return is higher or lower than 12% for Project C2. Phoenix Company can invest in each of three cheese-making projects: C1, C2, and C3. Each project re- Exercise 25-14 quires an initial investment of $228,000 and would yield the following annual cash flows. Computation and interpretation of net present value and internal rate of return C1 C3 C2 Year 1 $ 12,000 $ 96,000 $180,000 108,000 96,000 60,000 P3 P4 Year 3 . 168,000 96,000 48 48,000 Totals I. Assuming that the company requires a 12% return from its investments, use net present value to deter- mine which projects, if any, should be acquired. 2. Using the answer from part 1, explain whether the internal rate of return is higher or lower than 12% for Project C2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts