Question: Exercise 2A-2 Activity-Based Absorption Costing as an Alternative to Traditional Product Costing [LO2-5] Harrison Company makes two products and uses a traditional costing system in

Exercise 2A-2 Activity-Based Absorption Costing as an Alternative to Traditional Product Costing [LO2-5]

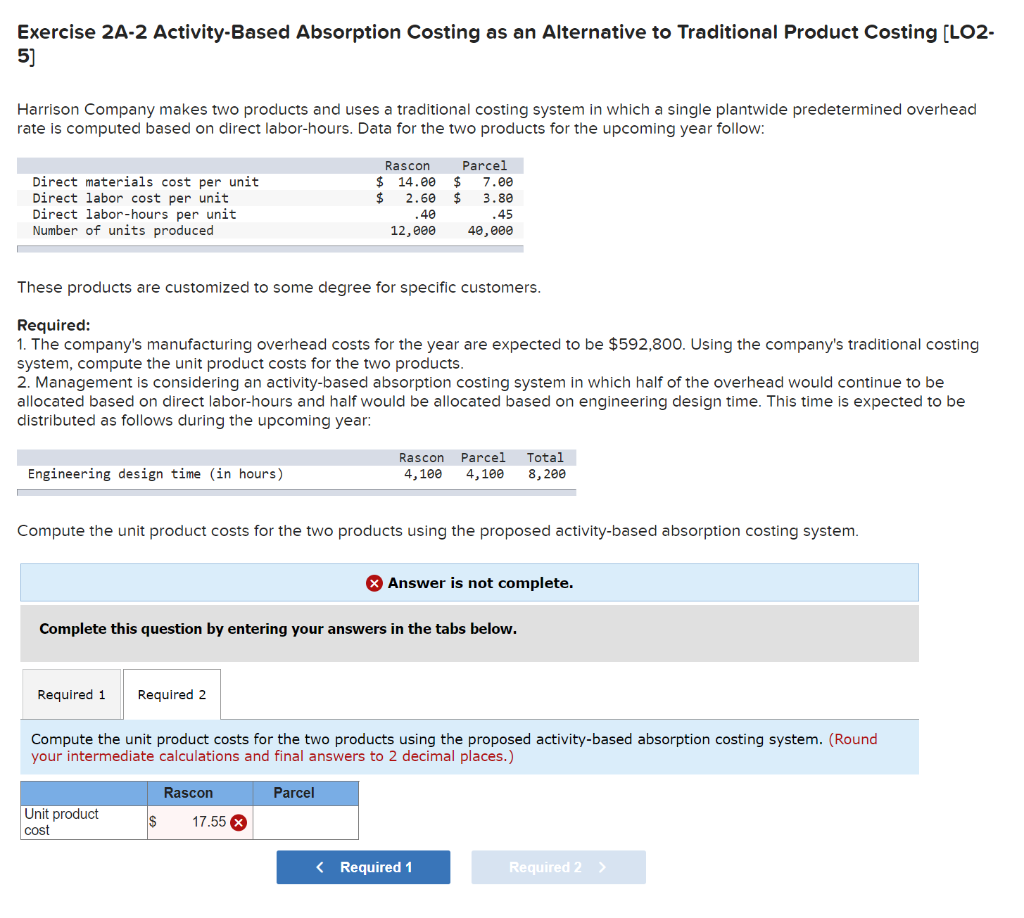

Harrison Company makes two products and uses a traditional costing system in which a single plantwide predetermined overhead rate is computed based on direct labor-hours. Data for the two products for the upcoming year follow:

| Rascon | Parcel | |||||

| Direct materials cost per unit | $ | 14.00 | $ | 7.00 | ||

| Direct labor cost per unit | $ | 2.60 | $ | 3.80 | ||

| Direct labor-hours per unit | .40 | .45 | ||||

| Number of units produced | 12,000 | 40,000 | ||||

These products are customized to some degree for specific customers.

Required:

1. The company's manufacturing overhead costs for the year are expected to be $592,800. Using the company's traditional costing system, compute the unit product costs for the two products.

2. Management is considering an activity-based absorption costing system in which half of the overhead would continue to be allocated based on direct labor-hours and half would be allocated based on engineering design time. This time is expected to be distributed as follows during the upcoming year:

| Rascon | Parcel | Total | |

| Engineering design time (in hours) | 4,100 | 4,100 | 8,200 |

Compute the unit product costs for the two products using the proposed activity-based absorption costing system.

Exercise 2A-2 Activity-Based Absorption Costing as an Alternative to Traditional Product Costing (LO2- 5) Harrison Company makes two products and uses a traditional costing system in which a single plantwide predetermined overhead rate is computed based on direct labor-hours. Data for the two products for the upcoming year follow: Direct materials cost per unit Direct labor cost per unit Direct labor-hours per unit Number of units produced Rascon Parcel $ 14.00 $ 7.00 $ 2.60 $ 3.80 .40 .45 12,000 40,000 These products are customized to some degree for specific customers. Required: 1. The company's manufacturing overhead costs for the year are expected to be $592,800. Using the company's traditional costing system, compute the unit product costs for the two products 2. Management is considering an activity-based absorption costing system in which half of the overhead would continue to be allocated based on direct labor-hours and half would be allocated based on engineering design time. This time is expected to be distributed as follows during the upcoming year: Engineering design time (in hours) Rascon Parcel 4,100 4,100 Total 8, 200 Compute the unit product costs for the two products using the proposed activity-based absorption costing system. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the unit product costs for the two products using the proposed activity-based absorption costing system. (Round your intermediate calculations and final answers to 2 decimal places.) Rascon Parcel Unit product cost 17.55 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts