Question: Exercise 3 0 . 8 A ( Bank Reconciliation Statement ) and Exercise 3 2 . 6 A + 3 3 . 3 A (

Exercise A Bank Reconciliation Statement

and Exercise AA Errors and Suspense

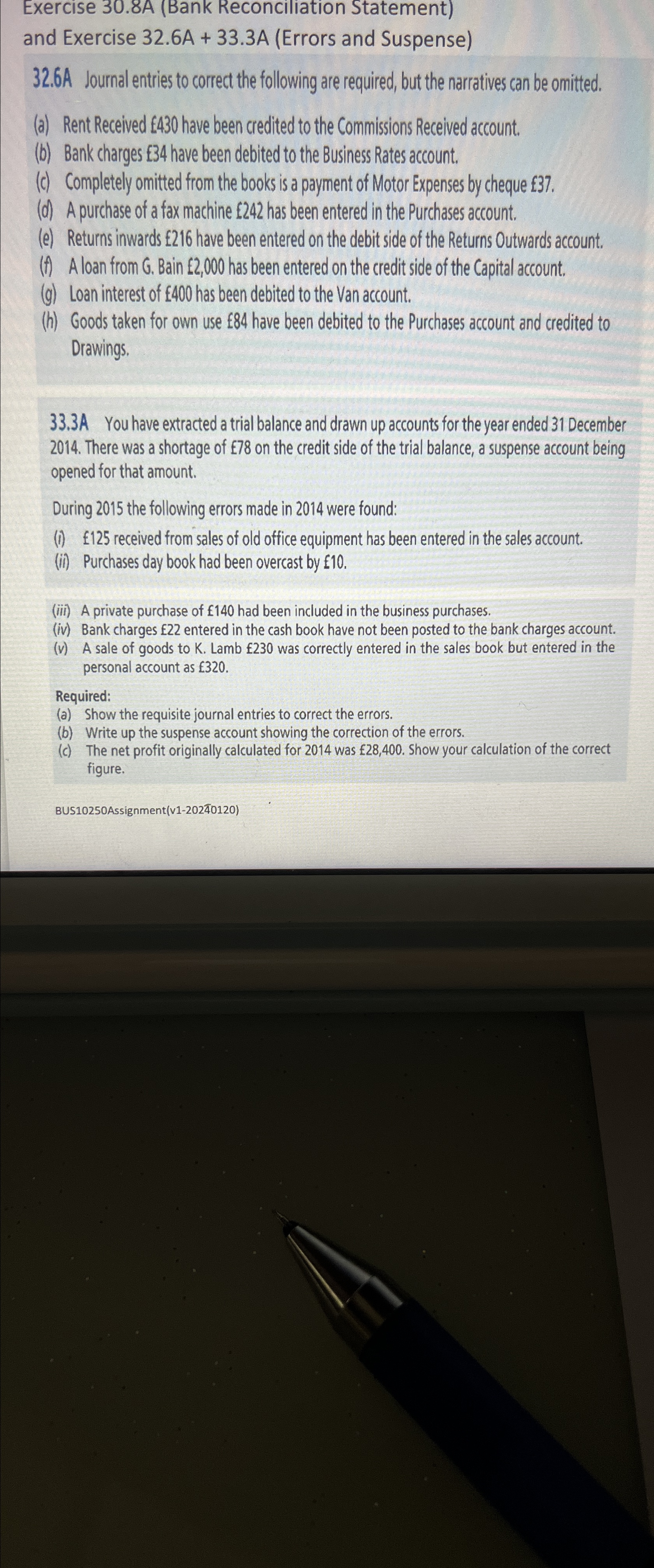

A Journal entries to correct the following are required, but the narratives can be omitted.

a Rent Received E have been credited to the Commissions Received account.

b Bank charges have been debited to the Business Rates account.

c Completely omitted from the books is a payment of Motor Expenses by cheque

d A purchase of a fax machine has been entered in the Purchases account.

e Returns inwards have been entered on the debit side of the Returns Outwards account.

f A loan from G Bain E has been entered on the credit side of the Capital account.

g Loan interest of has been debited to the Van account.

h Goods taken for own use have been debited to the Purchases account and credited to Drawings.

A You have extracted a trial balance and drawn up accounts for the year ended December There was a shortage of on the credit side of the trial balance, a suspense account being opened for that amount.

During the following errors made in were found:

i received from sales of old office equipment has been entered in the sales account.

ii Purchases day book had been overcast by

iii A private purchase of had been included in the business purchases.

iv Bank charges entered in the cash book have not been posted to the bank charges account.

v A sale of goods to K Lamb was correctly entered in the sales book but entered in the personal account as

Required:

a Show the requisite journal entries to correct the errors.

b Write up the suspense account showing the correction of the errors.

c The net profit originally calculated for was Show your calculation of the correct figure.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock