Question: Exercise 3 (20 points) We consider two stocks S, and Sy. At t=0, S.(0) - S,(0) = $100 The returns of the two stocks are

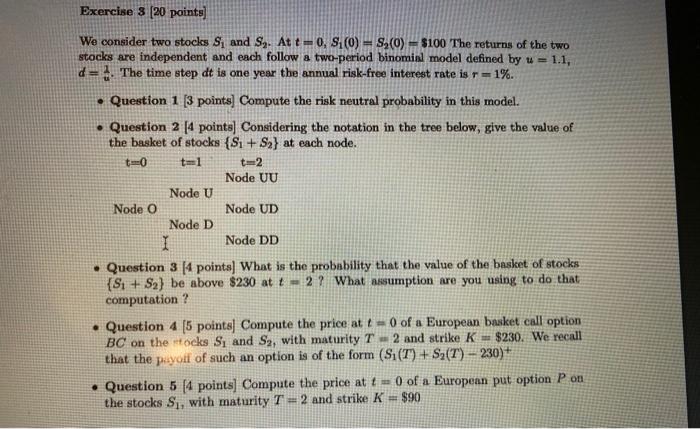

Exercise 3 (20 points) We consider two stocks S, and Sy. At t=0, S.(0) - S,(0) = $100 The returns of the two stocks are independent and each follow a two-period binomial model defined by u = 1.1, d= . The time step dt is one year the annual risk-free interest rate is r=1%. Question 1 [3 points) Compute the risk neutral probability in this model. Question 2 [4 points) Considering the notation in the tree below, give the value of the basket of stocks {S1 + S2} at each node. t=0 t=2 Node UU Node U Node o Node UD Node D I Node DD Question 3 4 points) What is the probability that the value of the basket of stocks {S1 + S2) be above $230 at t2? What assumption are you using to do that computation ? Question 4 [5 points) Compute the price at t = 0 of a European basket call option BC on the stocks S, and Sy, with maturity T2 and strike K$230. We recall that the puyot of such an option is of the form (Si(T) + S (T) - 230)+ Question 5 (4 points) Compute the price at 10 of a European put option P on the stocks S, with maturity T = 2 and strike K - $90 Exercise 3 (20 points) We consider two stocks S, and Sy. At t=0, S.(0) - S,(0) = $100 The returns of the two stocks are independent and each follow a two-period binomial model defined by u = 1.1, d= . The time step dt is one year the annual risk-free interest rate is r=1%. Question 1 [3 points) Compute the risk neutral probability in this model. Question 2 [4 points) Considering the notation in the tree below, give the value of the basket of stocks {S1 + S2} at each node. t=0 t=2 Node UU Node U Node o Node UD Node D I Node DD Question 3 4 points) What is the probability that the value of the basket of stocks {S1 + S2) be above $230 at t2? What assumption are you using to do that computation ? Question 4 [5 points) Compute the price at t = 0 of a European basket call option BC on the stocks S, and Sy, with maturity T2 and strike K$230. We recall that the puyot of such an option is of the form (Si(T) + S (T) - 230)+ Question 5 (4 points) Compute the price at 10 of a European put option P on the stocks S, with maturity T = 2 and strike K - $90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts