Question: Exercise 3. A. In the table are data on two companies. The T-bill rate is 4% and the market risk premium is 6%. The standard

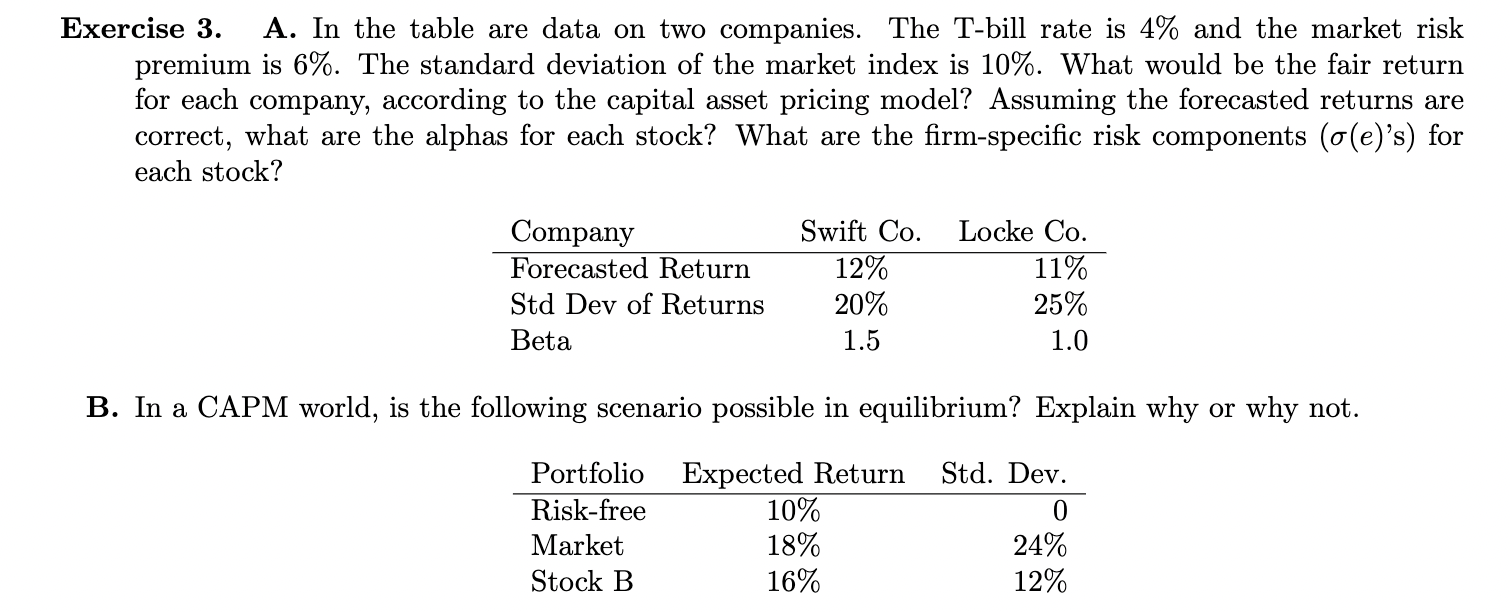

Exercise 3. A. In the table are data on two companies. The T-bill rate is 4% and the market risk premium is 6%. The standard deviation of the market index is 10%. What would be the fair return for each company, according to the capital asset pricing model? Assuming the forecasted returns are correct, what are the alphas for each stock? What are the firm-specific risk components (o(e)'s) for each stock? Company Forecasted Return Std Dev of Returns Beta Swift Co. 12% 20% 1.5 Locke Co. 11% 25% 1.0 B. In a CAPM world, is the following scenario possible in equilibrium? Explain why or why not. Portfolio Risk-free Market Stock B Expected Return 10% 18% 16% Std. Dev. 0 24% 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts