Question: Exercise 3 A zero recovery CDS is a contract that works exactly like a standard CDS contract, with the following exception - in the credit

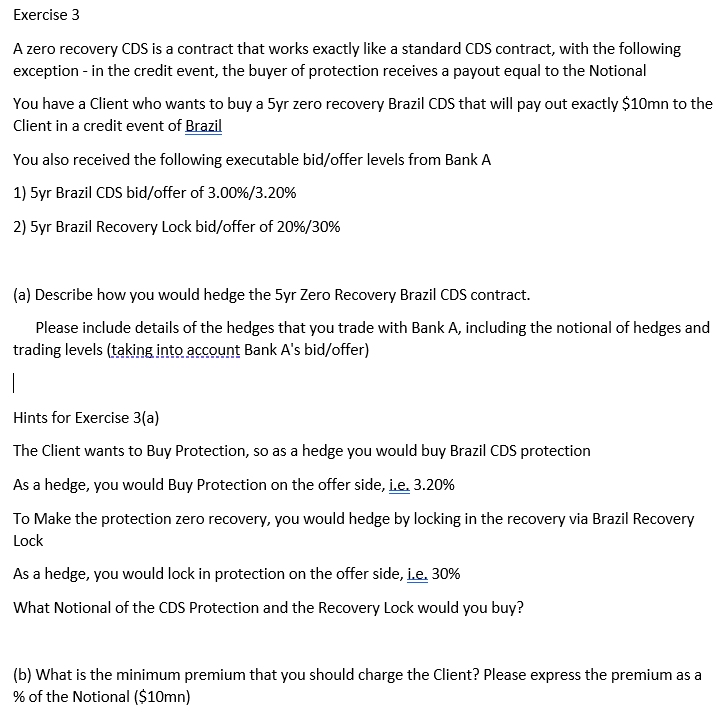

Exercise 3 A zero recovery CDS is a contract that works exactly like a standard CDS contract, with the following exception - in the credit event, the buyer of protection receives a payout equal to the Notional You have a client who wants to buy a 5yr zero recovery Brazil CDS that will pay out exactly $10mn to the Client in a credit event of Brazil You also received the following executable bid/offer levels from Bank A 1) 5yr Brazil CDS bid/offer of 3.00%/3.20% 2) 5yr Brazil Recovery Lock bid/offer of 20%/30% (a) Describe how you would hedge the 5yr Zero Recovery Brazil CDS contract. Please include details of the hedges that you trade with Bank A, including the notional of hedges and trading levels (taking into account Bank A's bid/offer) 1 Hints for Exercise 3(a) The Client wants to Buy Protection, so as a hedge you would buy Brazil CDS protection As a hedge, you would Buy Protection on the offer side, i.e. 3.20% To Make the protection zero recovery, you would hedge by locking in the recovery via Brazil Recovery Lock As a hedge, you would lock in protection on the offer side, i.e. 30% What Notional of the CDS Protection and the Recovery Lock would you buy? (b) What is the minimum premium that you should charge the Client? Please express the premium as a % of the Notional ($10mn) Exercise 3 A zero recovery CDS is a contract that works exactly like a standard CDS contract, with the following exception - in the credit event, the buyer of protection receives a payout equal to the Notional You have a client who wants to buy a 5yr zero recovery Brazil CDS that will pay out exactly $10mn to the Client in a credit event of Brazil You also received the following executable bid/offer levels from Bank A 1) 5yr Brazil CDS bid/offer of 3.00%/3.20% 2) 5yr Brazil Recovery Lock bid/offer of 20%/30% (a) Describe how you would hedge the 5yr Zero Recovery Brazil CDS contract. Please include details of the hedges that you trade with Bank A, including the notional of hedges and trading levels (taking into account Bank A's bid/offer) 1 Hints for Exercise 3(a) The Client wants to Buy Protection, so as a hedge you would buy Brazil CDS protection As a hedge, you would Buy Protection on the offer side, i.e. 3.20% To Make the protection zero recovery, you would hedge by locking in the recovery via Brazil Recovery Lock As a hedge, you would lock in protection on the offer side, i.e. 30% What Notional of the CDS Protection and the Recovery Lock would you buy? (b) What is the minimum premium that you should charge the Client? Please express the premium as a % of the Notional ($10mn)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts