Question: A zero recovery CDS is a contract that works exactly like a standard CDS contract, with the following exception - in the credit event,

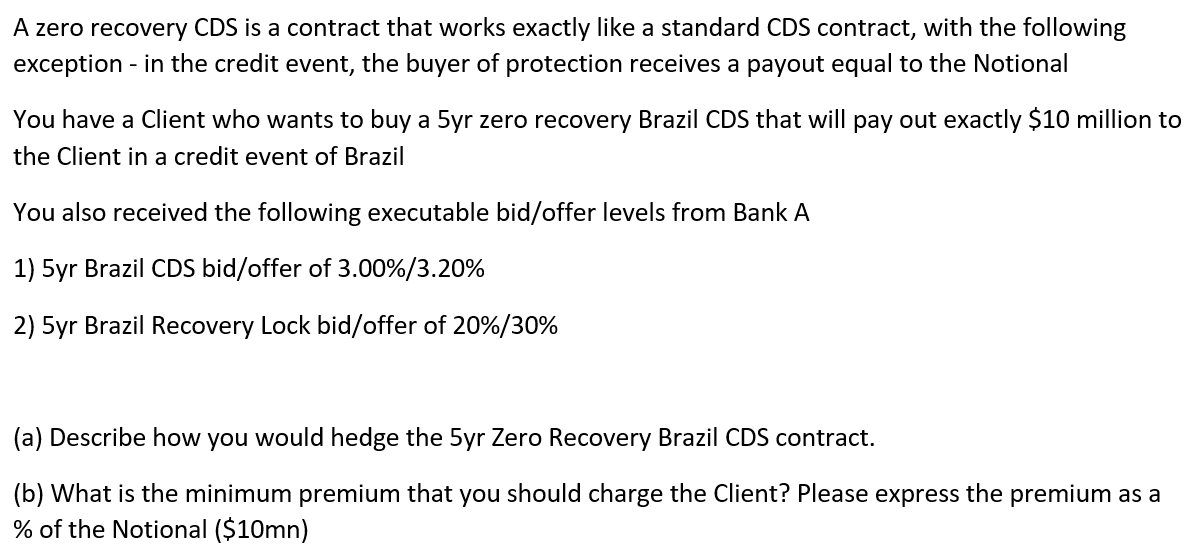

A zero recovery CDS is a contract that works exactly like a standard CDS contract, with the following exception - in the credit event, the buyer of protection receives a payout equal to the Notional You have a Client who wants to buy a 5yr zero recovery Brazil CDS that will pay out exactly $10 million to the Client in a credit event of Brazil You also received the following executable bid/offer levels from Bank A 1) 5yr Brazil CDS bid/offer of 3.00%/3.20% 2) 5yr Brazil Recovery Lock bid/offer of 20%/30% (a) Describe how you would hedge the 5yr Zero Recovery Brazil CDS contract. (b) What is the minimum premium that you should charge the Client? Please express the premium as a % of the Notional ($10mn)

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

a To hedge the 5yr Zero Recovery Brazil CDS contract we need to enter into offsetting positions in standard Brazil CDS and Brazil Recovery Lock contra... View full answer

Get step-by-step solutions from verified subject matter experts