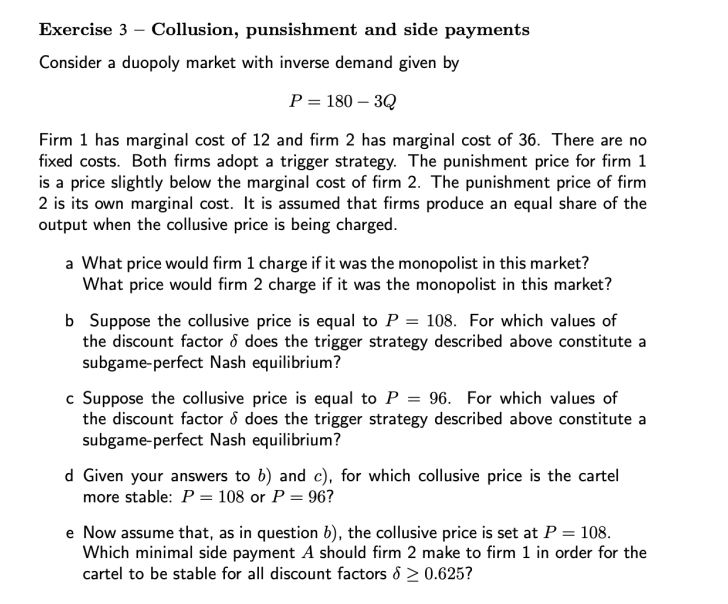

Question: Exercise 3 - Collusion, punsishment and side payments Consider a duopoly market with inverse demand given by [ P = 1 8 0 -

Exercise Collusion, punsishment and side payments

Consider a duopoly market with inverse demand given by

P Q

Firm has marginal cost of and firm has marginal cost of There are no fixed costs. Both firms adopt a trigger strategy. The punishment price for firm is a price slightly below the marginal cost of firm The punishment price of firm is its own marginal cost. It is assumed that firms produce an equal share of the output when the collusive price is being charged.

a What price would firm charge if it was the monopolist in this market? What price would firm charge if it was the monopolist in this market?

b Suppose the collusive price is equal to P For which values of the discount factor delta does the trigger strategy described above constitute a subgameperfect Nash equilibrium?

c Suppose the collusive price is equal to P For which values of the discount factor delta does the trigger strategy described above constitute a subgameperfect Nash equilibrium?

d Given your answers to b and c for which collusive price is the cartel more stable: P or P

e Now assume that, as in question b the collusive price is set at P Which minimal side payment A should firm make to firm in order for the cartel to be stable for all discount factors delta geq

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock