Question: Exercise 3 : Cost + Return Approach, Target Pricing ( 5 marks ) The new manager of an industrial company ( RM ) requested information

Exercise : Cost Return Approach, Target Pricing marks

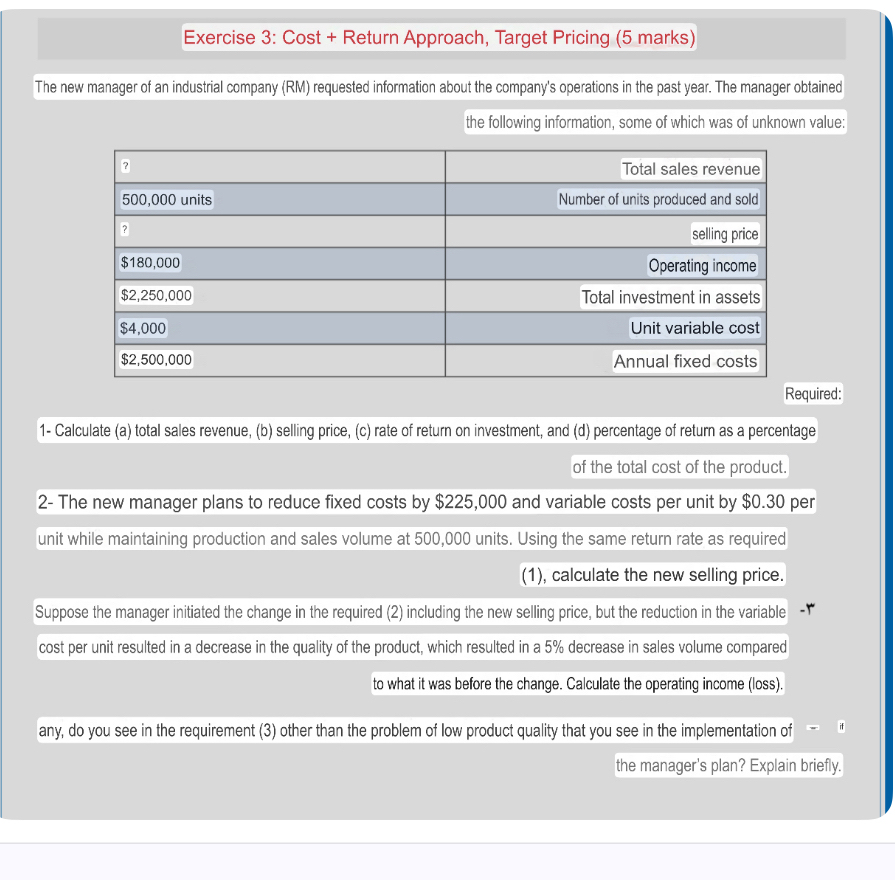

The new manager of an industrial company RM requested information about the company's operations in the past year. The manager obtained

the following information, some of which was of unknown value:

tableTotal sales revenue units,Number of units produced and soldselling price$Operating income$Total investment in assets$Unit variable cost$Annual fixed costs

Required:

Calculate a total sales revenue, b selling price, c rate of return on investment, and d percentage of return as a percentage

of the total cost of the product.

The new manager plans to reduce fixed costs by $ and variable costs per unit by $ per unit while maintaining production and sales volume at units. Using the same return rate as required

calculate the new selling price.

Suppose the manager initiated the change in the required including the new selling price, but the reduction in the variable cost per unit resulted in a decrease in the quality of the product, which resulted in a decrease in sales volume compared to what it was before the change. Calculate the operating income loss any, do you see in the requirement other than the problem of low product quality that you see in the implementation of

the manager's plan? Explain briefly.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock