Question: EXERCISE #3: Historically the S&P 500 Index has returned about 8% a year but returns are very uneven as recent experience has reminded us -

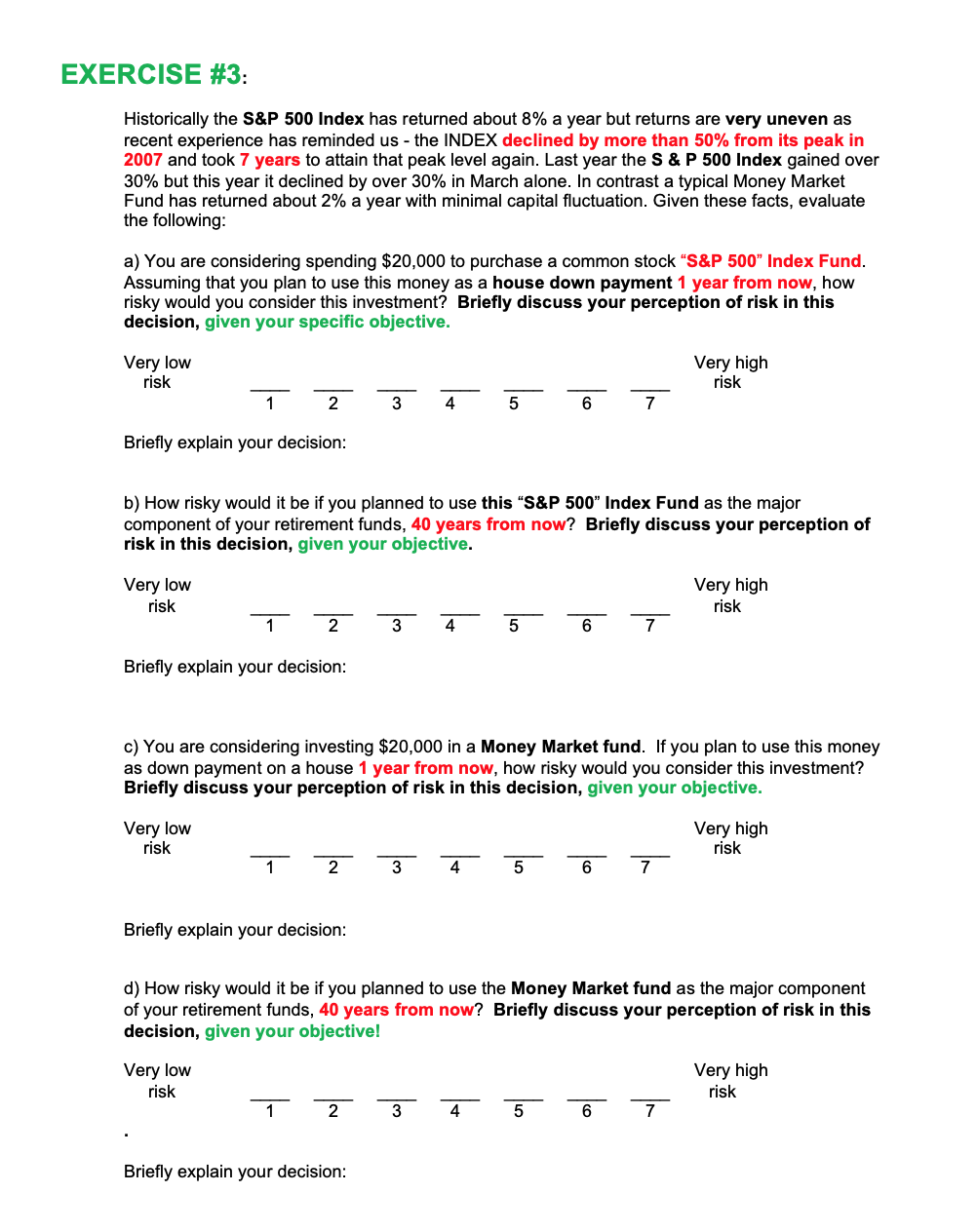

EXERCISE #3: Historically the S&P 500 Index has returned about 8% a year but returns are very uneven as recent experience has reminded us - the INDEX declined by more than 50% from its peak in 2007 and took 7 years to attain that peak level again. Last year the S&P 500 Index gained over 30% but this year it declined by over 30% in March alone. In contrast a typical Money Market Fund has returned about 2% a year with minimal capital fluctuation. Given these facts, evaluate the following: a) You are considering spending $20,000 to purchase a common stock "S&P 500" Index Fund. Assuming that you plan to use this money as a house down payment 1 year from now, how risky would you consider this investment? Briefly discuss your perception of risk in this decision, given your specific objective. Very low risk Very high risk 5 Briefly explain your decision: b) How risky would it be if you planned to use this "S&P 500" Index Fund as the major component of your retirement funds, 40 years from now? Briefly discuss your perception of risk in this decision, given your objective. Very low risk Very high risk 7 7 3 5 6 7 Briefly explain your decision: c) You are considering investing $20,000 in a Money Market fund. If you plan to use this money as down payment on a house 1 year from now, how risky would you consider this investment? Briefly discuss your perception of risk in this decision, given your objective. Very low risk Very high risk 7 z 3 I 5 o Briefly explain your decision: d) How risky would it be if you planned to use the Money Market fund as the major component of your retirement funds, 40 years from now? Briefly discuss your perception of risk in this decision, given your objective! Very low risk Very high risk T I 5 7 7 Briefly explain your decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts