Question: EXERCISE #3: Historically the S&P 500 Index has returned about 8% a year but returns are very uneven as recent experience has reminded us -

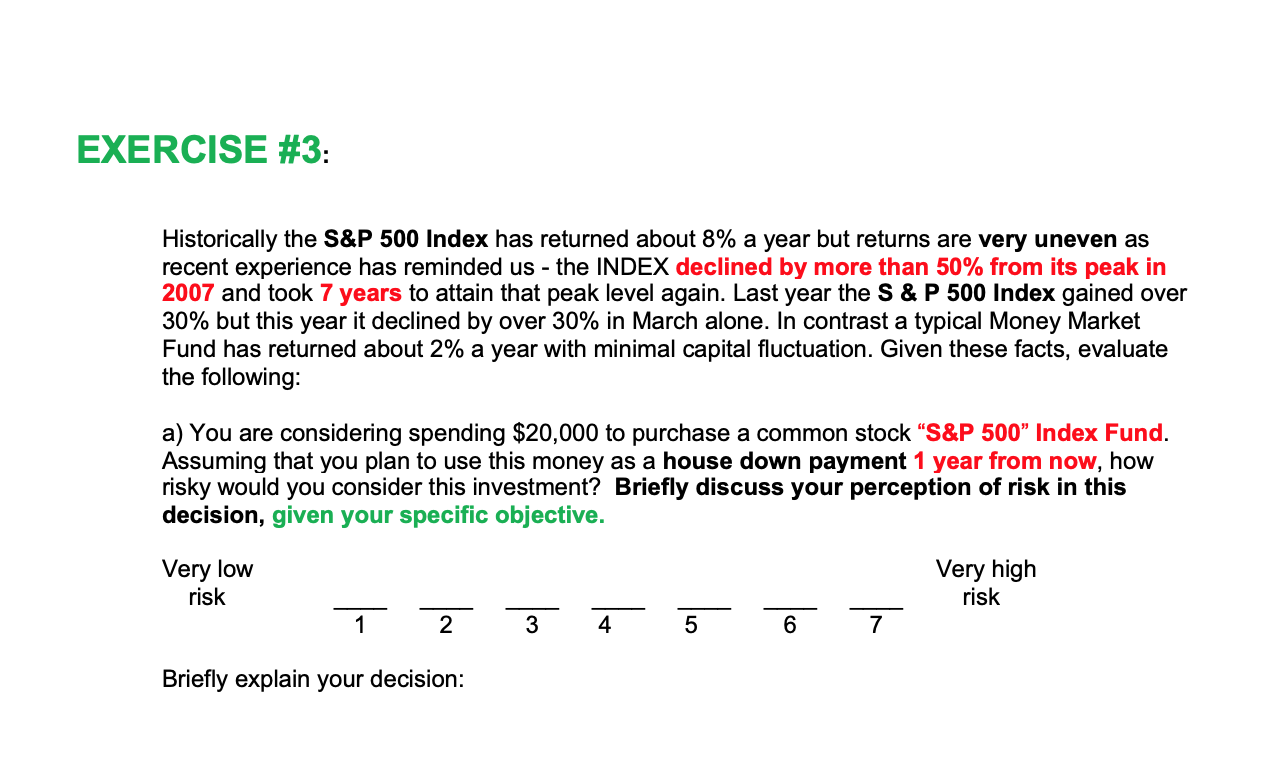

EXERCISE #3: Historically the S&P 500 Index has returned about 8% a year but returns are very uneven as recent experience has reminded us - the INDEX declined by more than 50% from its peak in 2007 and took 7 years to attain that peak level again. Last year the S&P 500 Index gained over 30% but this year it declined by over 30% in March alone. In contrast a typical Money Market Fund has returned about 2% a year with minimal capital fluctuation. Given these facts, evaluate the following: a) You are considering spending $20,000 to purchase a common stock S&P 500 Index Fund. Assuming that you plan to use this money as a house down payment 1 year from now, how risky would you consider this investment? Briefly discuss your perception of risk in this decision, given your specific objective. Very low risk Very high risk 1 2 3 5 6 7 Briefly explain your decision: EXERCISE #3: Historically the S&P 500 Index has returned about 8% a year but returns are very uneven as recent experience has reminded us - the INDEX declined by more than 50% from its peak in 2007 and took 7 years to attain that peak level again. Last year the S&P 500 Index gained over 30% but this year it declined by over 30% in March alone. In contrast a typical Money Market Fund has returned about 2% a year with minimal capital fluctuation. Given these facts, evaluate the following: a) You are considering spending $20,000 to purchase a common stock S&P 500 Index Fund. Assuming that you plan to use this money as a house down payment 1 year from now, how risky would you consider this investment? Briefly discuss your perception of risk in this decision, given your specific objective. Very low risk Very high risk 1 2 3 5 6 7 Briefly explain your decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts