Question: Exercise 3 (Value at risk) (6 points) Consider the daily returns for the adjusted closing prices of the Apple stock (AAPL) over the period from

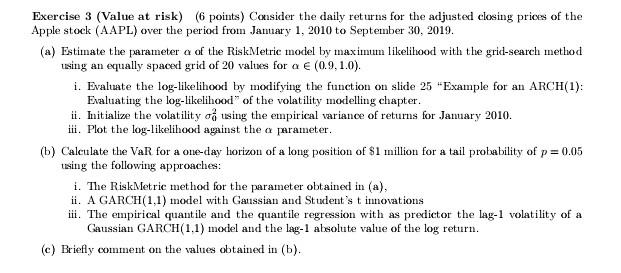

Exercise 3 (Value at risk) (6 points) Consider the daily returns for the adjusted closing prices of the Apple stock (AAPL) over the period from Jamary 1, 2010 to September 30, 2019. (a) Estimate the parameter a of the RiskMetric model by maximum likelihood with the grid-search method using an equally spaced grid of 20 values for a (0.9.1.0). i. Evaluate the log-likelihood by modifying the function on slide 25 "Example for an ARCH(1): Exaluating the log-likelihood" of the volatility modelling chapter. ii. Initialize the volatility o using the empirical variance of returns for Jamuary 2010. iii. Plot the log-likelihood against the parameter. (b) Calculate the VaR for a one-day horizou of a long position of $1 million for a tail probability of p = 0.05 using the following approaches: i. The Risk Metric method for the parameter obtained in (a), ii. A GARCH(1.1) model with Gaussian and Student's timovations iii. The empirical quant ile and the quantile regression with as predictor the lag-1 volatility of a Gaussian GARCH(1.1) model and the lg-1 absolute value of the log return. (c) Briefly comment on the values obtained in (b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts