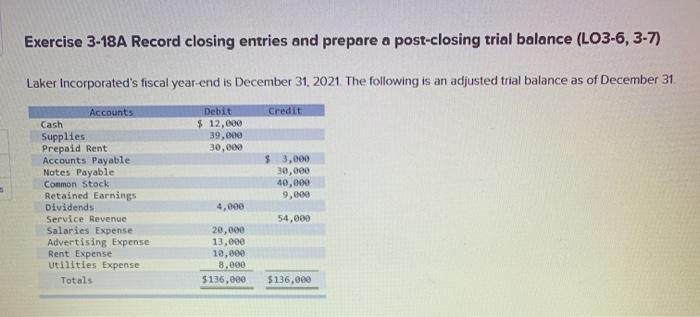

Question: Exercise 3-18A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) Laker Incorporated's fiscal year-end is December 31, 2021. The following is an

Exercise 3-18A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) Laker Incorporated's fiscal year-end is December 31, 2021. The following is an adjusted trial balance as of December 31 Credit Debit $ 12,000 39,000 30,000 Accounts Cash Supplies Prepaid Rent Accounts Payable Notes Payable Common Stock Retained Earnings Dividends Service Revenue Salaries Expense Advertising Expense Rent Expense Utilities Expense Totals $ 3.000 30,000 40,000 9,000 4,000 54,000 20,000 13,000 10,000 8.000 $136,000 $136,000 2. Calculate the ending balance of Retained Earnings. Retained earnings 3. Prepare a post-closing trial balance. LAKER INCORPORATED Post-Closing Trial Balance December 31, 2021 Accounts Debit Credit Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts