Question: undefined Exercise 3-18A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) Laker Incorporated's fiscal year-end is December 31, 2021. The following is

undefined

undefined

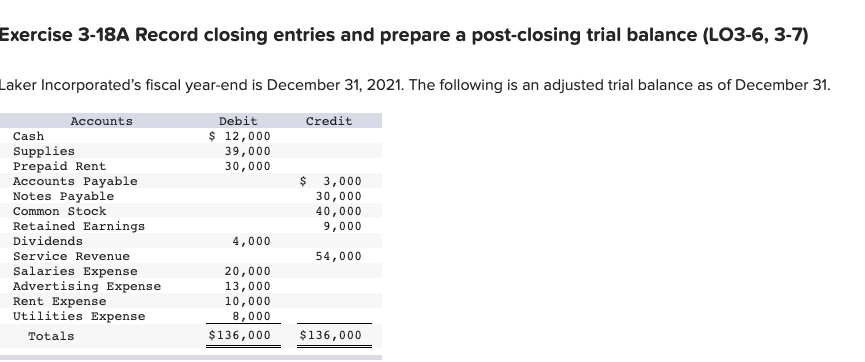

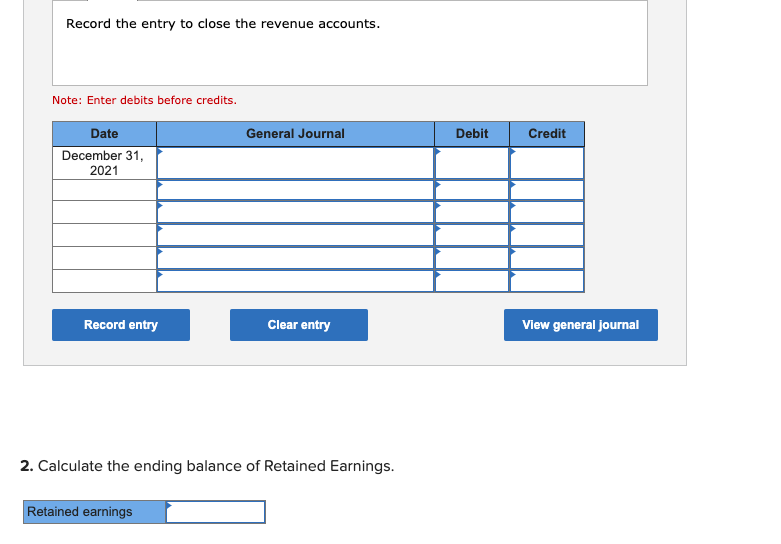

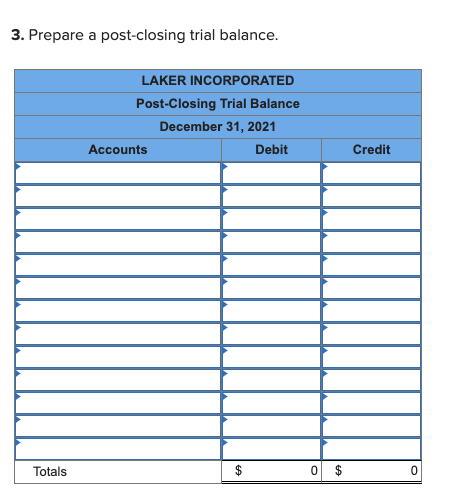

Exercise 3-18A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) Laker Incorporated's fiscal year-end is December 31, 2021. The following is an adjusted trial balance as of December 31. Credit Debit $ 12,000 39,000 30,000 Accounts Cash Supplies Prepaid Rent Accounts Payable Notes Payable Common Stock Retained Earnings Dividends Service Revenue Salaries Expense Advertising Expense Rent Expense Utilities Expense Totals $ 3,000 30,000 40,000 9,000 4,000 54,000 20,000 13,000 10,000 8,000 $ 136,000 $ 136,000 Record the entry to close the revenue accounts. Note: Enter debits before credits. General Journal Debit Credit Date December 31, 2021 Record entry Clear entry View general journal 2. Calculate the ending balance of Retained Earnings. Retained earnings 3. Prepare a post-closing trial balance. LAKER INCORPORATED Post-Closing Trial Balance December 31, 2021 Accounts Debit Credit Totals 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts