Question: Exercise 3.22. Consider again the one-period binomial asset pricing model. For a stock, let us write S(0) = S, S(1,1) = S(1) and S(1, 1)

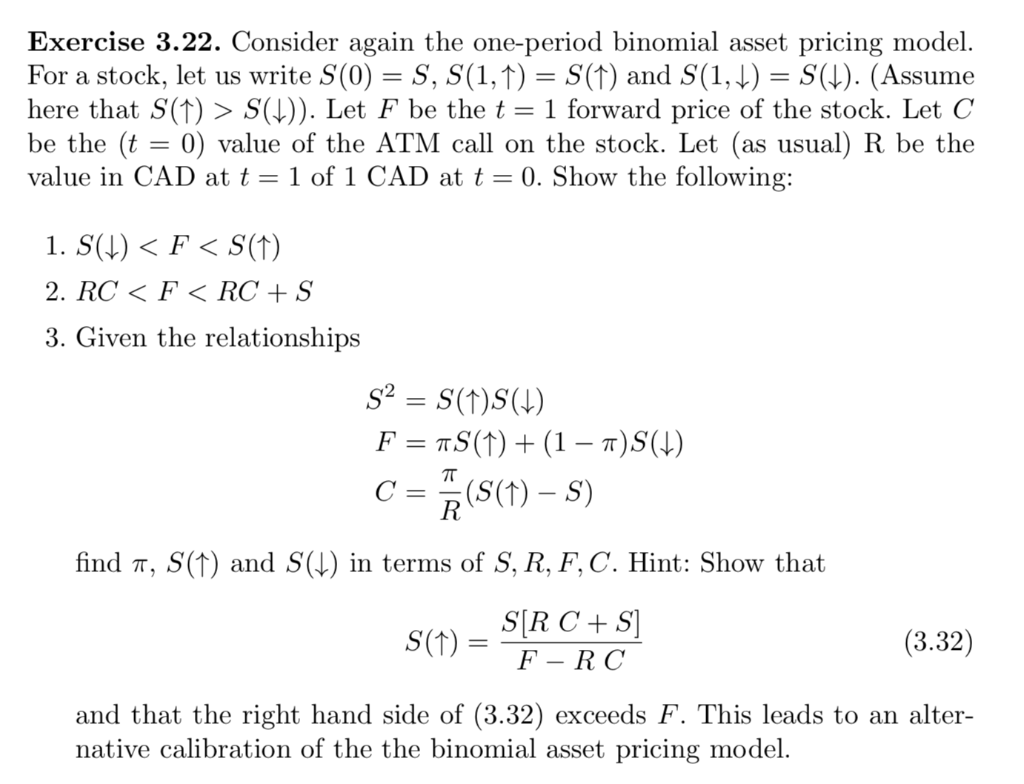

Exercise 3.22. Consider again the one-period binomial asset pricing model. For a stock, let us write S(0) = S, S(1,1) = S(1) and S(1, 1) = S(1). (Assume here that S(1) > SV)). Let F be the t= 1 forward price of the stock. Let C be the (t = 0) value of the ATM call on the stock. Let (as usual) R be the value in CAD at t = 1 of 1 CAD at t = 0. Show the following: 1. S(1) SV)). Let F be the t= 1 forward price of the stock. Let C be the (t = 0) value of the ATM call on the stock. Let (as usual) R be the value in CAD at t = 1 of 1 CAD at t = 0. Show the following: 1. S(1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts