Question: Exercise 3-26 (Algorithmic) (LO. 1) Compute the charitable contribution deduction (ignoring the percentage limitation) for each of the following Corporations. If required, round your answers

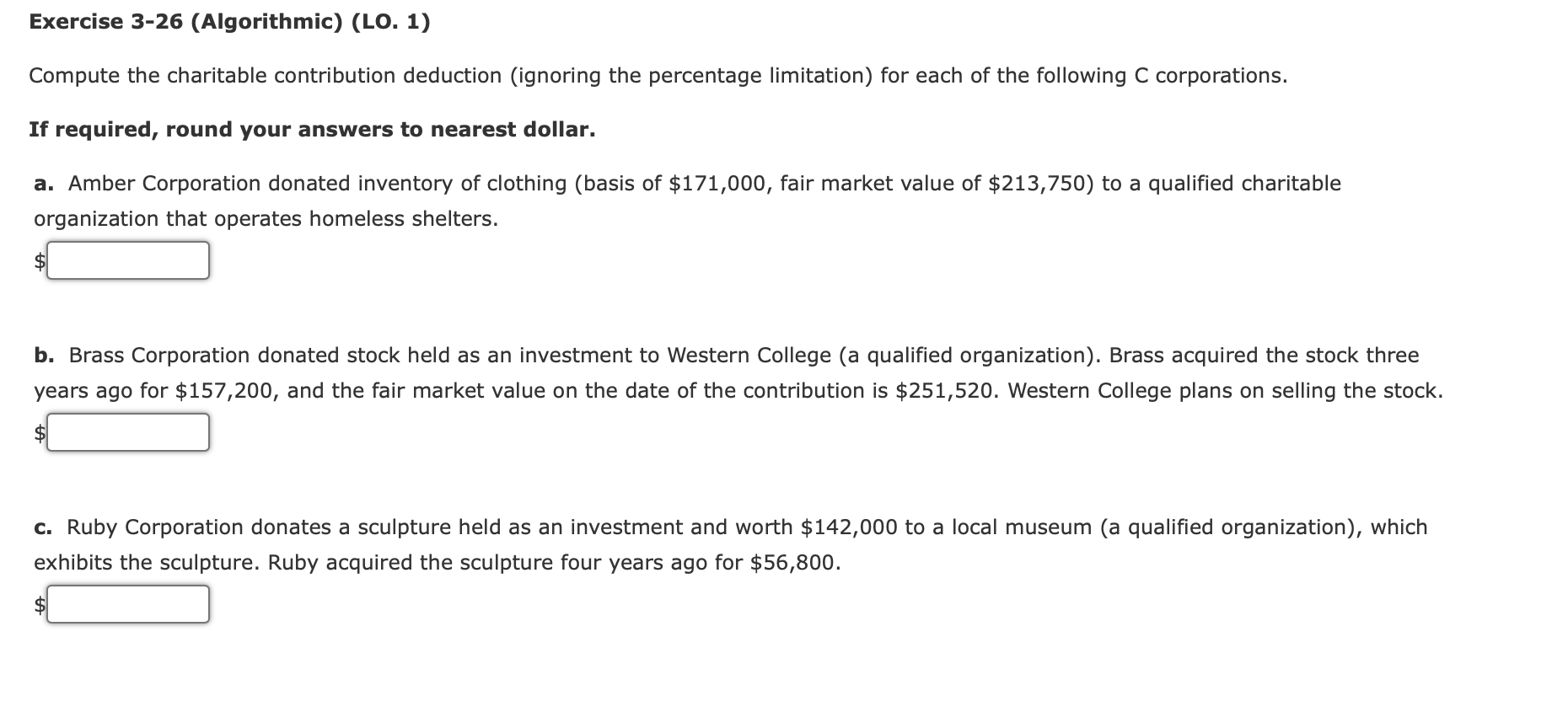

Exercise 3-26 (Algorithmic) (LO. 1) Compute the charitable contribution deduction (ignoring the percentage limitation) for each of the following Corporations. If required, round your answers to nearest dollar. a. Amber Corporation donated inventory of clothing (basis of $171,000, fair market value of $213,750 ) to a qualified charitable organization that operates homeless shelters. q b. Brass Corporation donated stock held as an investment to Western College (a qualified organization). Brass acquired the stock three years ago for $157,200, and the fair market value on the date of the contribution is $251,520. Western College plans on selling the stock. $ c. Ruby Corporation donates a sculpture held as an investment and worth $142,000 to a local museum (a qualified organization), which exhibits the sculpture. Ruby acquired the sculpture four years ago for $56,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts