Question: Exercise 3-27 (Algorithmic) (LO. 1) Compute the charitable contribution deduction (ignoring the percentage limitation) for each of the following C corporations. If required, round your

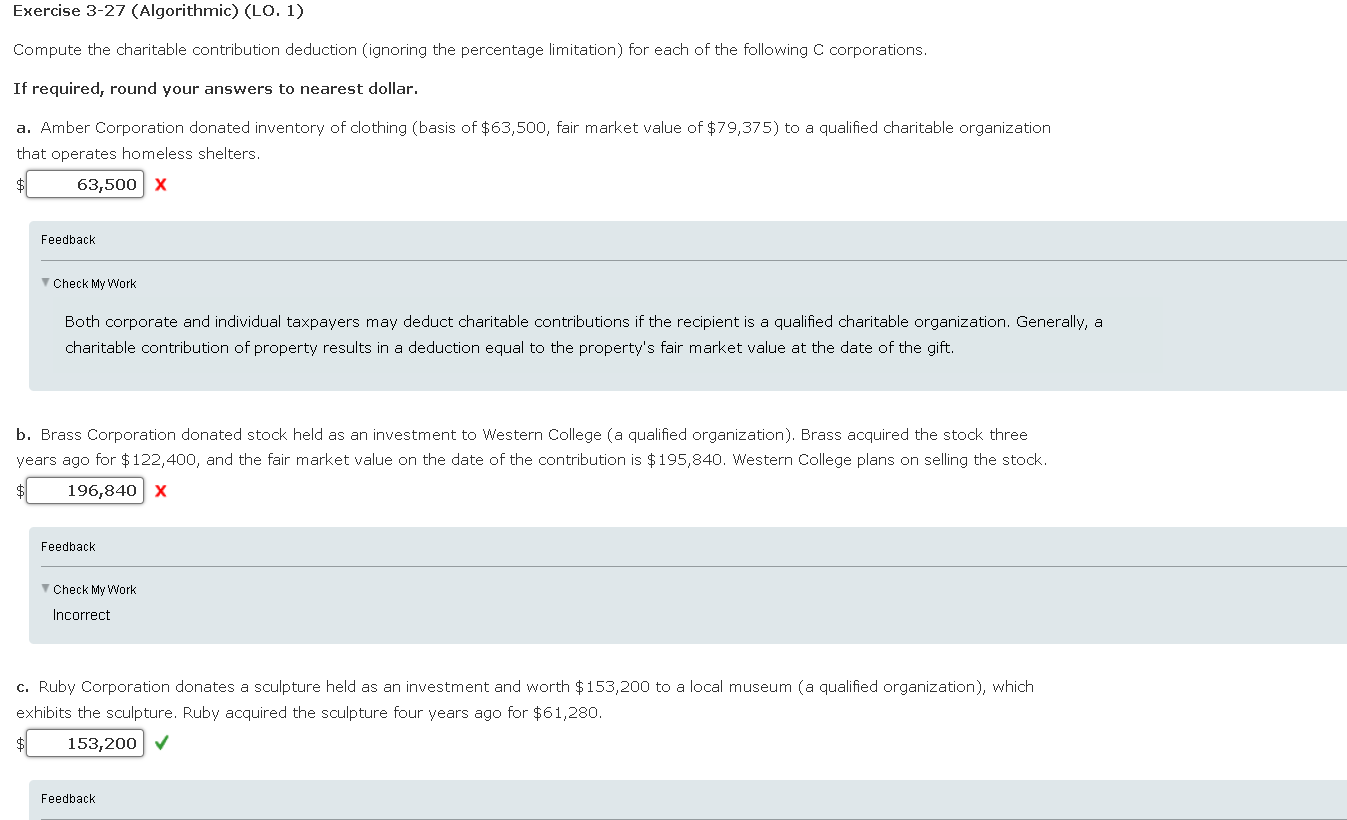

Exercise 3-27 (Algorithmic) (LO. 1) Compute the charitable contribution deduction (ignoring the percentage limitation) for each of the following C corporations. If required, round your answers to nearest dollar. a. Amber Corporation donated inventory of clothing (basis of $63,500, fair market value of $79,375) to a qualified charitable organization that operates homeless shelters. $ 63,500 X Feedback Check My Work Both corporate and individual taxpayers may deduct charitable contributions if the recipient is a qualified charitable organization. Generally, a charitable contribution of property results in a deduction equal to the property's fair market value at the date of the gift. b. Brass Corporation donated stock held as an investment to Western College (a qualified organization). Brass acquired the stock three years ago for $ 122,400, and the fair market value on the date of the contribution is $ 195,840. Western College plans on selling the stock. 196,840 X Feedback Check My Work Incorrect c. Ruby Corporation donates a sculpture held as an investment and worth $ 153,200 to a local museum (a qualified organization), which exhibits the sculpture. Ruby acquired the sculpture four years ago for $61,280. 153,200 Feedback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts