Question: Exercise 3.4 (An Anticipated Output Shock I) Consider a two-period, small open endowment economy populated by a large number of households with preferences described by

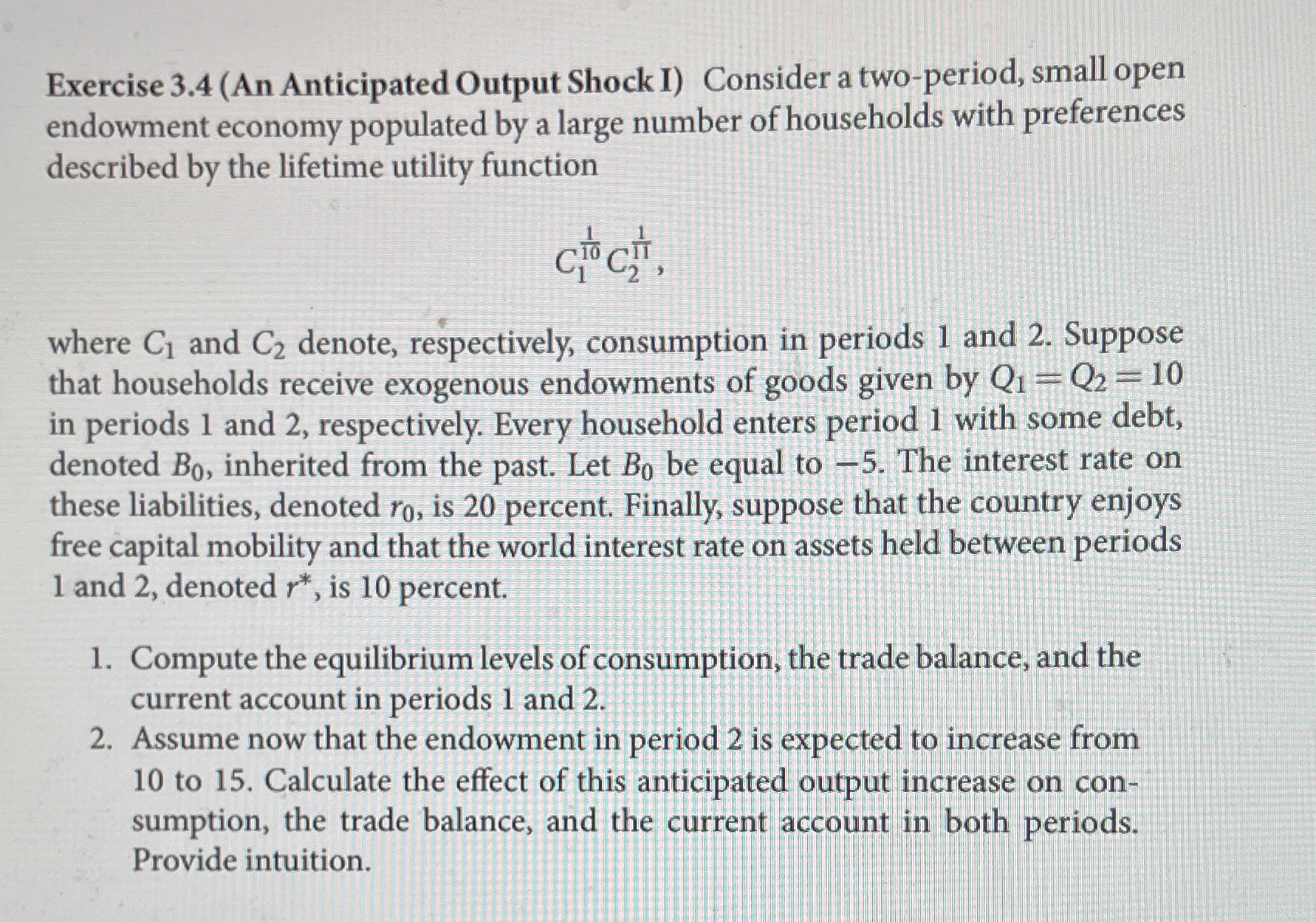

Exercise 3.4 (An Anticipated Output Shock I) Consider a two-period, small open endowment economy populated by a large number of households with preferences described by the lifetime utility function CTO CH , where C1 and C2 denote, respectively, consumption in periods 1 and 2. Suppose that households receive exogenous endowments of goods given by Q1 - Q2 - 10 in periods 1 and 2, respectively. Every household enters period 1 with some debt, denoted Bo, inherited from the past. Let Bo be equal to -5. The interest rate on these liabilities, denoted ro, is 20 percent. Finally, suppose that the country enjoys free capital mobility and that the world interest rate on assets held between periods 1 and 2, denoted r*, is 10 percent. 1. Compute the equilibrium levels of consumption, the trade balance, and the current account in periods 1 and 2. 2. Assume now that the endowment in period 2 is expected to increase from 10 to 15. Calculate the effect of this anticipated output increase on con- sumption, the trade balance, and the current account in both periods. Provide intuition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts